Taxation Principles | Free Economic Blogs

Table of Contents

Taxation Principles

Taxes

According to Prof. Taussig: “The essence of a tax as distinguished from other charges by the government is the absence of a direct quid pro quo between the taxpayer and the public authority.”

According to Prof. Seligman: “A tax is a compulsory contribution from the person to the government without reference to special benefits conferred.”

A tax possesses the following essential characteristics

1) It is a compulsory contribution to the government and every citizen of the country is legally bound to pay the tax imposed upon him. It is a major source of revenue for the government. If any person does not pay a tax, he can be punished by the government.

2) Tax is paid by a taxpayer to enable the government to incur expenses in the common interests of society.

3) The payment of a tax by a person does not entitle him to receive any direct and proportionate benefits or services from the government in return for the tax.

4) Tax is imposed on income, property or commodities and services.

- Microeconomic Definition | Historical Review of Microeconomics

- Scope Or Nature of Microeconomics

- Features of Microeconomics

- Importance of Microeconomics

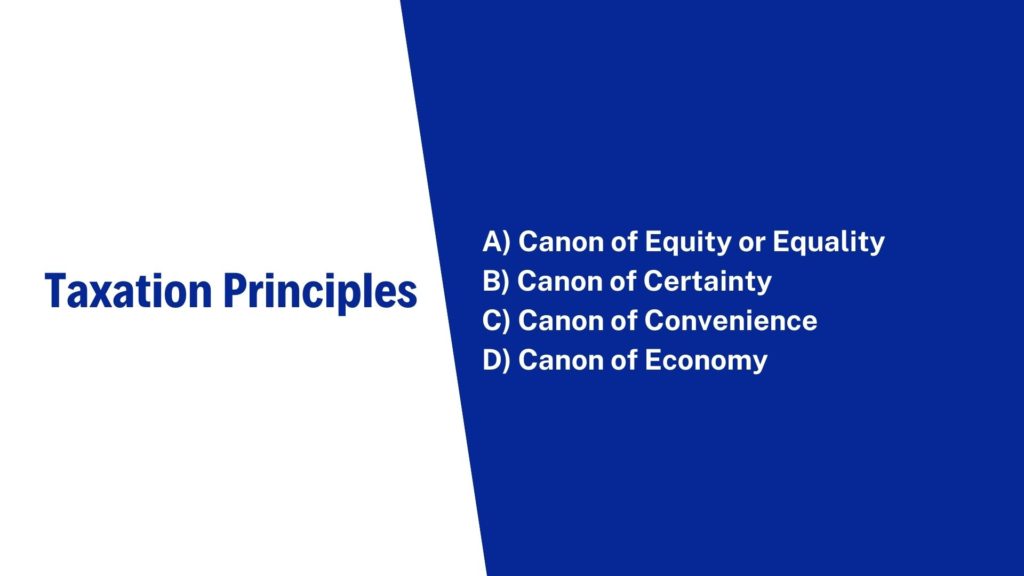

Taxation Principles

A) Canon of Equity or Equality

Smith suggested that every person will pay the taxes to the government in proportion to his ‘ability to pay’. It means rich people should pay more tax compared to the poor.

B) Canon of Certainty

According to Smith, the taxpayer should know in advance how much tax he has to pay, at what time he has to pay the tax, and in what form the tax is to be paid to the government.

C) Canon of Convenience

According to this canon, every tax should be levied in such a manner and at such a time that it becomes convenient to the taxpayer.

D) Canon of Economy

According to this canon, the cost of tax collection should be the minimum. If a major portion of the tax proceeds is spent on the tax collection itself, then such a tax cannot be considered as a good tax.