Principles of Public Expenditure | Free Economic Blogs

Table of Contents

Principles of Public Expenditure

What is Public Expenditure?

The term public expenditure refers to the expenses of public authorities like the Central, state, and local governments. Public expenditure occupies a very important place in the study of public finance. It is the end of all financial activities of the government. Public expenditure is incurred basically to maximize social welfare

Public expenditure is that expenditure which is incurred by the public authority [Central, State, and Local Bodies] for the protection of their citizens, for satisfying their collective needs, and for promoting their economic and social welfare. Till the 20th century, the majority of the governments had adopted a policy of laissez-faire.

Under this policy, the functions of government were restricted to obligatory functions. But, modern governments not only perform obligatory functions such as defence and civil administration but also perform optional functions for promoting the social and economic development of their countries. Therefore, the study of public expenditure is an important part of the study of public finance.

- Microeconomic Definition | Historical Review of Microeconomics

- Scope Or Nature of Microeconomics

- Features of Microeconomics

- Importance of Microeconomics

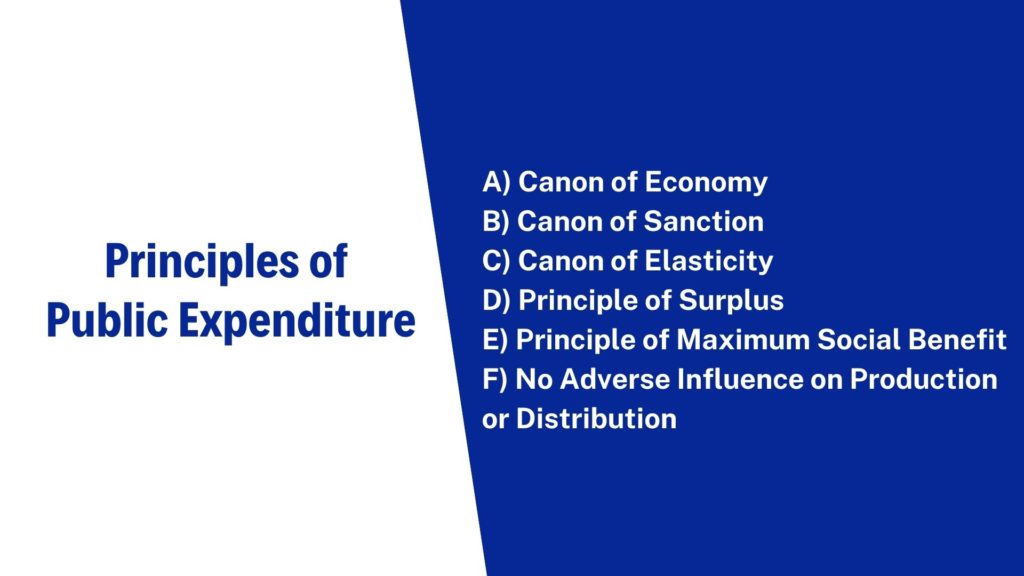

Principles of Public Expenditure

A) Canon of Economy

Although the aim of public expenditure is to maximize the social benefit, yet it does not exonerate the government from exercising the utmost economy in its expenditure.

B) Canon of Sanction

Another important principle of public expenditure is that before it is actually incurred it should be sanctioned by a competent authority. Unauthorized spending is bound to lead to extravagance and over-spending.

C) Canon of Elasticity

Another sane principle of public expenditure is that it should be fairly elastic. It should be possible for public authorities to vary the expenditure according to need or circumstances.

D) Principle of Surplus

It is considered a sound or orthodox principle of public expenditure that as far as possible public expenditure should be kept well within the revenue of the State so that a surplus is left at the end of the year.

E) Principle of Maximum Social Benefit

It is necessary that all public expenditure should satisfy one fundamental test, viz., that of Maximum Social Advantage. That is, the government should discover and maintain an optimum level of public expenditure by balancing social benefits and social costs

F) No Adverse Influence on Production or Distribution

It is also necessary to ensure that public expenditure should exercise a healthy influence both on the production and distribution of wealth in the community. It should stimulate productive activity so that income and employment of the living.