HSC SP Question Paper 2022 July with Solution | Maharashtra Board (Download Free PDF)

Table of Contents

HSC SP Question Paper 2022 July with Solution

- 12th Commerce July 2022 Question Papers

- 12th Commerce March 2021 Question Papers

- 12th Commerce March 2022 Question Papers

- 12th Commerce March 2023 Question Papers

- 12th Commerce July 2023 Question Papers

- 12th Commerce Feb 2024 Question Papers

- 12th Commerce Feb 2025 Question Papers

12th Commerce SP Textbook Solution

HSC SP Question Paper 2022 July with Solution

Q. 1. (A) Select the correct answer from the options given below and rewrite the statement : (5) {20}

1) _______ refers to any kind of fixed assets.

(a) Authorised Capital

(b) Issued Capital

(c) Fixed Capital

2) The holder of bond is _______ of the company

(a) secretary

(b) owner

(c) creditor

3) _______ protects the interest of debenture holders.

(a) Debenture trustees

(b) Debenture holders

(c) Redemption reserve

4) Dividend is recommended by _________.

(a) Board of Directors

(b) Shareholders

(c) Depositors

5) Money market is a market for lending and borrowing of funds for ________ term.

a) short

b) medium

c) long

(B) Write a word/term/phrase that can be substituted for each of the following statements : (5)

(1) The value of share which is written on the share certificate.

Answer: Face Value

(2) Highest bid price in Book Building Method.

Answer: Cap price/ceiling price

(3) Company which can accept deposits from public upto 35% of its paid-up share capital and free reserves.

Answer: Government Company

(4) The shareholders who get dividends at a fluctuating rate.

Answer: Equity Shareholder

(5) The first stock exchange in India to be recognized under the Securities Contracts Regulation Act.

Answer: Bombay Stock Exchange

(C) State whether the following statements are true or false: (5)

(1) Fixed capital is also referred as circulating capital. (False)

(2) Sweat equity shares are offered to directors or employees of a company. (True)

(3) Payment of interest on debentures does not depend on the profits of the company. (True)

(4) IEPF is the fund created by company. (False)

(5) A stock exchange is a reliable barometer to measure the economic condition of a country. (True)

(D) Select the correct option from the bracket: (5)

| Group A | Group B |

| a) Secured debentures | 1) charge on assets |

| b) Retained earnings | 2) Accumulated corporate profit |

| c) Depositor | 3) Creditor of the company |

| d) At annual general meeting | 4) Final Dividend |

| e) funds for long term | 5) Capital Market |

(Retained earnings, funds for long term, charge on assets, At annual general meeting, Creditor of the company)

Q. 2. Explain the following terms/concepts : (Any Four) (12)

1) Financial market

Answer: a) A Financial Market is a market where Financial assets i.e. Financial instruments are exchanged or bought and sold.

b) Financial market helps in the mobilization of savings and convert them into investments.

c) Thus financial market acts as an intermediary between investors and borrowers.

d) Financial instruments are documents in the form of legal agreement between two parties having a monetary value.

2) Final dividend

Answer: a) It is declared and paid after the close of the financial year.

b) It is decided and recommended by the Board of Directors. It is declared by the shareholders in the AGM.

c) It is declared from different sources like; current year’s profits, free reserves, capital profits, Money provided by Govt. for dividend, etc.

3) Deposit receipt

Answer: Company has to issue Deposit Receipt to the depositors within twenty-one (21) days from date of receipt of money or realization of cheque.

b) The receipt has to be signed b the officer duly authorized b the Board of Directors.

c) The Receipt contains the name and address of the depositor, amount of deposit, rate of interest payable and

date on which it is repayable.

4) Employees stock option scheme

Answer: Under this scheme, permanent employees, Directors or officers of the company or its Holding Company or Subsidiary company are offered the benefit or right to purchase the Equity Shares of the company at a future date at a pre-determined price.

ESOS encourages employees as they feel proud to be owners of the company for which they are working and company also benefits as it can retain good employees.

5) Owned Capital.

Answer: a) The capital raised by company with the help of owners (shareholders) is called owned capital

or ownership capital. The shareholder’s purchase shares of the company and supply necessary capital. It is one form of owned capital.

b) Another form of owned capital is retained earnings. It is also known as ploughing back of profit. It is a reinvestment of profit in the business b the company itself. Retained earnings is an internal source of finance.

c) Owned capital is regarded as a permanent capital, as it is returned only at the time of winding up of the company.

6) Working capital

Answer: Working capital is the capital that is used to carry out day-to-day business activities. After estimating the fixed capital requirement of the business firm, it is necessary to estimate the amount of capital, that would be needed to ensure the smooth functioning of the business firm. A business firm requires funds to store adequate raw material in stock. A firm would need capital to maintain sufficient stock of finished goods.

A business firm will have to arrange capital for the following :

a) For building up inventories

b) For financing receivables

c) For covering day-to-day operating expenses.

Q. 3. Study the following case/situation and express your opinion : (Any Two) (6)

(1) Gold Ltd. Company has recently come out with its public offer through FPO. Their issue was oversubscribed. The Board of Directors now wants to start the allotment process. Please advise the Board on:

a) Is Gold Ltd. Company a listed company?

b) How should the company inform the applicants to whom the company is allotting shares?

c) Within what period should the company issue a share certificate?

Solution:

a) Yes, Gold Ltd. company is a listed company.

b) The company should inform the applicants to whom the company is allotting shares by issuing a letter of allotment.

c) They must issue a share certificate within two months of allotment of shares.

(2) GCC financial plans to raise Rs 10 crores by issuing secured, Non-convertible debentures. However, as per the Articles of Association, the board of directors have authority only to raise upto 5 crores. They are also considering whether to go for private placement or make public offer. Please advise them on the following:

a) What can be the maximum tenure of the debentures to be issued?

b) Is the proposed issue within the borrowing powers of the board?

c) Within what period should company issue Debenture certificate?

Solution:

a) The debentures can be issued for a maximum tenure of 10 years.

b) No, The proposed issue is not within the borrowing powers of the board, because articles of association permit only up to Rs 5 Crore.

c) They must issue a share certificate within 6 months of allotment of debentures.

(3) Mr. S holds 50 shares of Peculiar Co. Ltd. in Demat form. The company has declared a dividend of Rs 5/- per share and a Bonus of 1:1 to its shareholders.

a) How will Mr. S get his dividend?

b) Will he get a Bonus share in Physical or Demat?

c) Who is entitled to dividend and Bonus: Mr. S or the depositor? (NSDL in this case)

Solution:

a) The account of Mr.S is automatically credited for dividends by the company through corporate actions.

b) Mr. S will get bonus shares in Demat mode. His account is automatically credited by the company through corporate actions.

c) Mr. S is the beneficial owner and therefore he is entitled to get dividend and bonus shares.

Balbharti Textbook Solutions for other subjects

Solution of all Chapters of SP

1 – 2 – 3 – 4 – 5 – 6 – 7 – 8 – 9 – 10 – 11 – 12

Q. 4. Distinguish between the following : (Any Three) (12)

1) Rights shares and Bonus shares

| Points | Rights Shares | Bonus Shares |

| 1) Meaning | In rights issue, shares are offered to the existing equity shareholders i.e. Company offers the shareholders the first option to buy the shares of the company. | Bonus shares are issued to the existing equity shareholders free of cost. |

| 2) Payment | Subscribers have to pay for the Rights Shares. Company only gives them a right to buy these shares. | Bonus shares are issued free of cost to the shareholders. |

| 3) Partly / fully paid up shares | Shareholders have to pay for these shares as Application Money, Allotment, Call Money etc. till the full money on shares is paid up. | Bonus shares are fully paid up shares. So no money has to be paid by the shareholders to the company. |

| 4) Minimum Subscription | Company has to obtain minimum subscription. If the company fails to receive minimum subscription, it has to refund the entire application money received. | There is no minimum subscription to be collected as Bonus shares are issued free of cost by the company. |

| 5) Right to Renounce | The shareholders can renounce his shares. | Shareholders cannot renounce his bonus shares. |

| 6) Purpose of Issue | Rights issue is done by a company when it wants to raise fresh funds but wants to give a chance to their existing members to increase their shareholding. | When company has accumulated huge profits or reserves and company wants to reward its existing Equity shareholders, company issues Bonus shares. |

2) Dividend and Interest

| Points | Dividend | Interest |

| 1) Meaning | Dividend is the return payable to the shareholders of the company for their investment in the share capital. | It is the return payable to the creditors of the company viz. Debenture holder / Deposit holders for the loan given b them to the company. |

| 2) Given to whom | It is paid to the member i.e. the owners of the company. | It is paid to the creditor of the company. |

| 3) Obligation | It is to be paid only when company has made profits. Therefore no obligation / compulsion to pay dividend. | It is not linked to the profits of the company. Payment of interest is an obligation and is to be paid b the company compulsorily. |

| 4) When Payable | It is payable when a company earns sufficient profit in a year after fulfilling all obligations. | It is payable every year irrespective of the profits of the company. |

| 5) Rate | It is paid at a fluctuating rate to the equity shareholders since it is linked to the profits of company. | Rate of interest is fixed and pre- determined at the time of issue of the security. |

| 6) Resolution | Payment of Final Dividend requires a Board resolution and an ordinary resolution at the AGM while Interim Dividend can be paid b passing only a Board Resolution. | Payment of interest does not require passing of a resolution at any meeting. |

| 7) Accounting Treatment / Aspect | Dividend is an appropriation of profit. | Interest is a charge on profit. |

3) Transfer of Shares and Transmission of Shares

| Points | Transfer of Shares | Transmission of Shares |

| 1) Meaning | Transfer of shares means voluntarily or deliberately giving away one’s shares to another person by entering into a contract with the buyer. | It means a transfer of ownership of a member’s shares to his legal representative due to operation of law. It takes place on death, insolvency or insanity of the members. |

| 2) When done | It is done when the member wants to sell his shares or give his shares as gift. | It is done when the member dies or becomes insolvent or insane. |

| 3) Nature of Action | It is a voluntary action taken by the member. | It is an involuntary action. It is due to the operation of law. |

| 4) Parties involved | In transfer of shares, there are two parties involved- the member who is called as transferor and the buyer who is called as transferee. | There is only one party e.g. the nominee of the member in case of death of the member or the legal representative. |

| 5) Instrument of transfer | Transfer requires an Instrument of transfer. It is a contract between the transferor and transferee. | No Instrument of transfer is needed. |

| 6) Initiated by | The transferor initiates the transfer process. | Legal representative or official the receiver initiates the process of transmission. |

| 7) Consideration | Transfer of shares is done often by the member to receive some consideration (money) i.e. the buyer has to pay for the shares. (Except given as gift.) | No consideration is involved here. The legal heir or official receiver need not pay for the shares. |

| 8) Liability | The liability of the transferor ends after the shares are transferred. | Original liability of the member continues in case of transmission of shares. |

| 9) Stamp Duty | Stamp duty as per the market value of shares has to be paid. | No stamp duty is to be paid |

4) Primary market and Secondary market

| Points | Primary Market | Secondary Market |

| 1) Meaning | The issue of new shares by the company is done in the primary market. | The securities issued earlier are traded in the secondary market. |

| 2) Mode of Investment | Direct investment in the securities. Securities are acquired directly from the company. | Indirect investment as the securities are acquired from other stakeholders. |

| 3) Parties in action | The parties dealing in this market are company and investors. | The parties dealing in this market are only investors. |

| 4) Intermediary | The underwriters are the intermediaries. | The security brokers are the intermediaries. |

| 5) Value of security | The price of security in the primary market is fixed as it is decided by the company. | The price of security is fluctuating, depending on the demand and supply conditions in the market. |

Q. 5. Answer the following questions in brief: (Any Two) (8)

1) State the provisions for Rights Issue.

Answer: When a company wants to raise further capital, it can issue shares to its existing Equity shareholders in proportion to their existing shareholding. Such an issue of shares is called as ‘Rights Issue’ of shares.

A company making Rights Issue has to fulfill the following provisions.

a) Rights shares are sold to the existing shareholders at a price that is lesser than its market price.

b) A company has to send a ‘Letter of offer’ to the existing shareholders at the time of issuing Rights shares.

c) The letter of offer shall mention :

i) the number of shares offered

ii) the period of offer i.e. offer is valid for a period not less than fifteen days and not exceeding thirty days from the date of offer.

iii) the right to renounce i.e. the shareholders have a right to give up their shares in favour of any other person.

d) The letter of offer can be sent by registered post, speed post, courier, or through electronic mode.

e) If a shareholder does not respond to the Rights Issue offer within the stipulated time, it is implied that he is not interested in the offer and the company can offer the unsold shares to new investors.

f) The company has to obtain a minimum subscription i.e. 90% of the issue.

2) State any four factors affecting fixed capital requirement.

Answer: Fixed capital is the capital that is used for buying fixed assets that are used for a longer period of time in the business. These assets are not meant for resale.

Factors affecting fixed capital requirement:

1) Nature of business:

Manufacturing industries and public utilities have to invest huge amount of funds to acquire fixed assets. While Trading business may not need huge investments in fixed assets.

2) Size of business:

Where a business firm is set up to carry on large-scale operations, its fixed capital requirements are likely to be high. It is because most of their production processes are based on automatic machines and equipment.

3) Scope of business:

There are business firms which are formed to carry on production or distribution on a large scale. Such businesses would require more amount of fixed capital.

4) Extent of lease or rent:

If an entrepreneur decides to acquire assets on lease or on rental basis, less amount of funds for fixed assets will be needed for the business.

5) Arrangement of sub-contract:

If the business wants to sub-contract some processes of production to others, limited assets are required to carry out the production. It would minimize fixed capital requirement of business.

3. Explain four advantages of depository system to the company.

Answer: Following are the advantages of Depository System to Companies:

1) Up-to-date Information:

The up-to-date information about investors is provided by the depository.

2) Reduction in costs and efforts:

Costs, efforts and time involved in printing and distribution of certificates in cases of new issues, bonus, transfers, etc. is saved.

3) Better Investor-Company Relationships:

The complaints arising out of loss of certificates, signature differences, long lapses of time in executing requests, etc. are substantially reduced. It leads to better communication with investors and increased goodwill for the company.

4) International Investment:

Under Depositor System, better and quicker services can be provided and this attracts investments from abroad.

Q. 6. Justify the following statement : (Any Two) (8)

1) Depository provides easy and quicker transfer of shares.

Answer:

a) Under a depository system securities are held in electronic form.

b) The transfer and settlement of securities done electronically.

c) Efforts in filling transfer forms and lodging the documents is eliminated.

d) Also the stamp duty levied on the transfer of physical shares is not applicable.

e) Processing time in the transfer of securities is reduced and neither the securities nor the cash is tied/held up for unnecessarily a long time.

f) Hence, Depository provides easy and quicker transfer of shares.

2) Stock exchanges work for the growth of the Indian economy.

Answer:

a) Stock markets are organised and regulated market which protects the interests of the investors.

b) In stock exchange, securities of various companies are bought and sold.

c) Investors invest in companies which give good return on investments.

d) Hence companies, too, try to invest in most productive investment projects.

e) This leads to capital formation as well as economic growth.

f) Hence, Stock exchanges work for the growth of the Indian economy.

3) Interest is a liability / obligation of the company..

Answer:

a) Interest is a payment made for using another money so it is the cost of renting the money for the borrower and it is the income from lending money for the lender.

b) The company has to pay interest, if it has borrowed money from creditors like Debenture holders, Depositors, Bondholders, etc.

c) Interest is the liability of the company as it is a payment made for using money from the lender.

d) Interest is a charge against the profit of the company.

e) Even if, the company makes no profit, it has to pay interest to borrowers.

f) Thus, it is rightly said that interest is a liability/ obligation for the company.

4) Equity share capital is risk capital.

Answer:

a) Equity shareholders have a claim over residual proceeds of the company.

b) In the event of winding up, they are the last to be paid off after setting the claims of creditors and external liabilities.

c) They have fluctuating returns and risk of fluctuating market value.

d) Equity capital is permanent capital and not refunded during the lifetime of the company.

e) Not having any assurance as regards dividend, repayment of capital Equity Capital becomes risk capital.

f) Thus, it is rightly said, that equity capital is risk capital.

Q. 7. Attempt the following : (Any Two) (10)

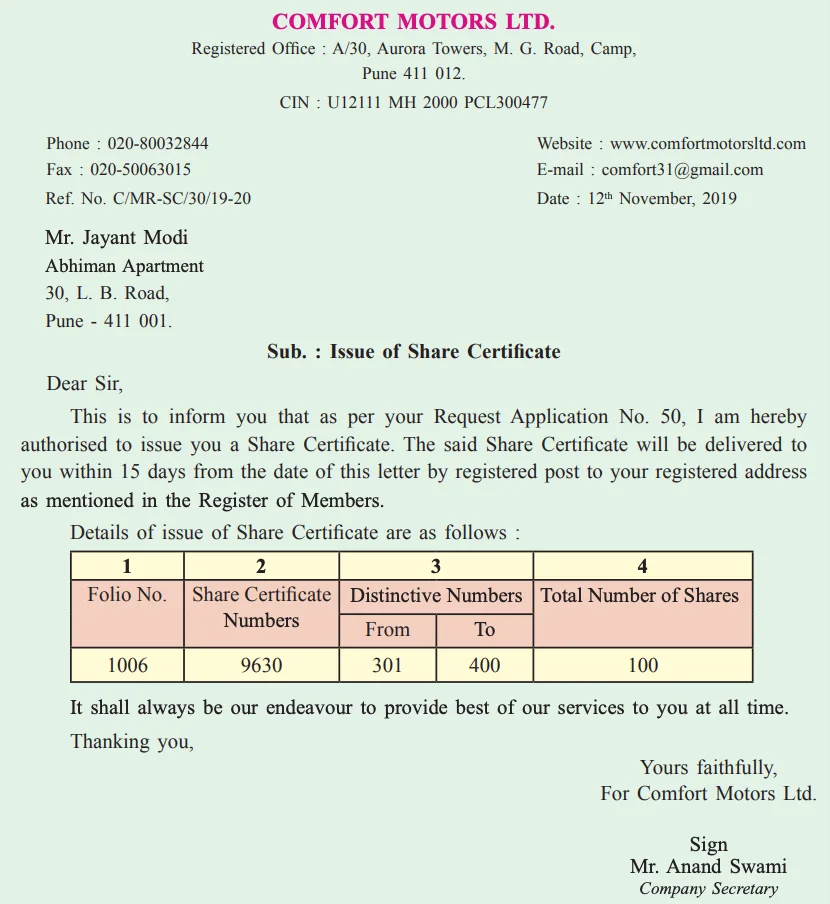

1) Write a letter to the member for the issue of share certificate.

Answer:

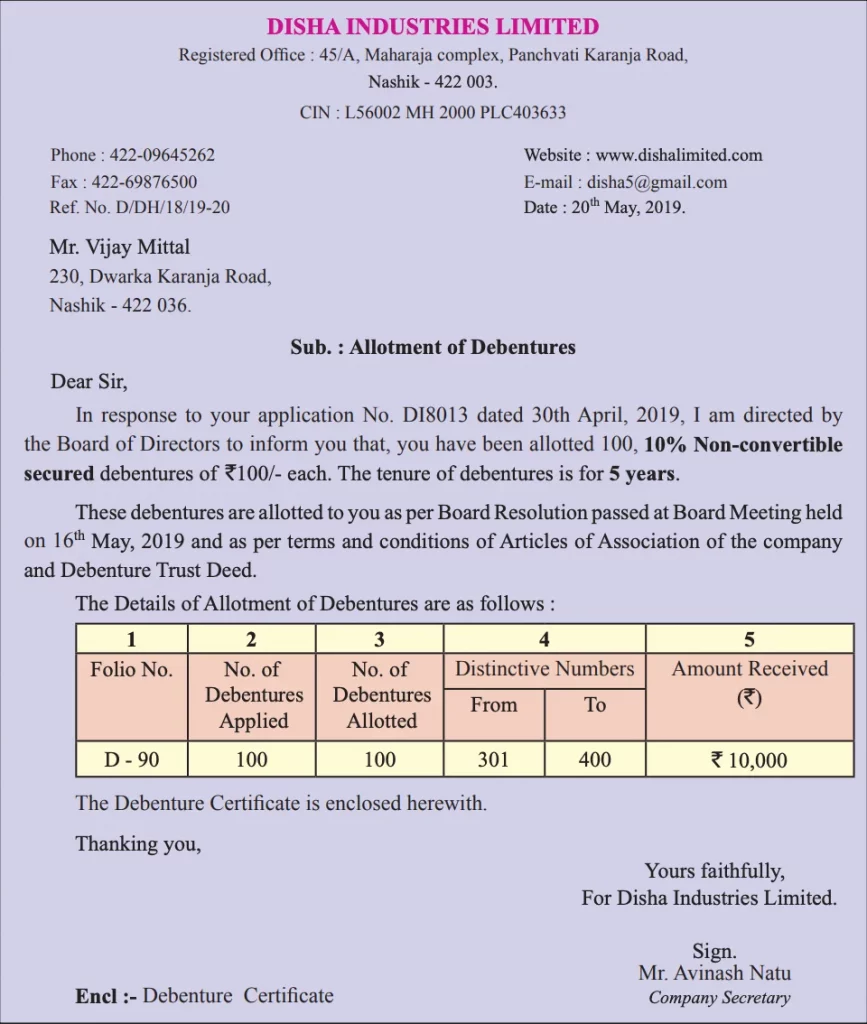

2) Draft a letter of allotment to debentureholder.

Answer:

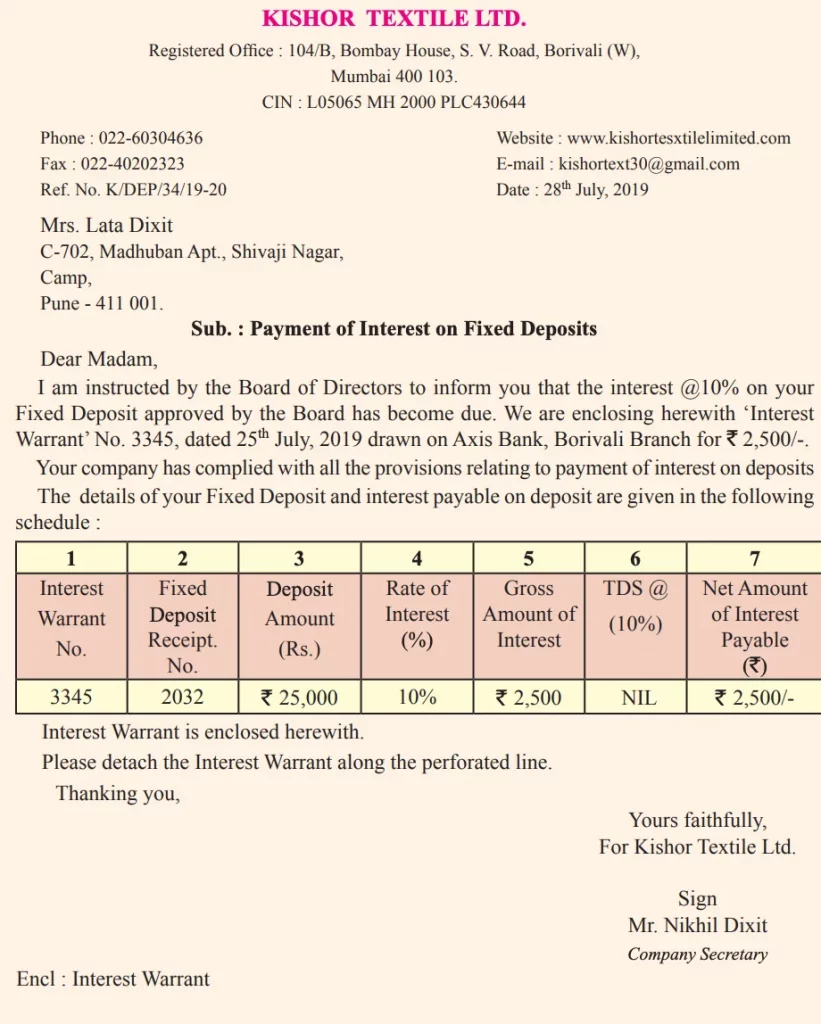

3) Draft a letter to depositor informing him about payment of interest through Interest warrant.

Answer:

Q. 8. Answer the following questions : (Any One) (8)

1. What is an equity share? Explain its features.

Answer:

Equity shares are also known as ordinary shares.

Companies Act defines equity shares as ‘those shares which are not preference shares.

The above definition reveals that :

a) The equity shares do not enjoy a preference for the dividend.

b) The equity shares do not have priority for repayment of capital at the time of winding up of the company

Equity shares are a fundamental source of financing business activities. Equity shareholders own the company and bear the ultimate risk associated with the ownership.

Features of Equity Shares

1) Permanent Capital:

Equity shares are irredeemable shares. The amount received from equity shares is not refundable by the company during its lifetime. Equity shares become refundable only in the event of the winding up of the company or the company decides to buy back shares.

2) Fluctuating Dividend:

Equity shares do not have a fixed rate of dividend. The rate of dividend depends upon the amount of profit earned by the company. If the company earns more profit, the dividend is paid at a higher rate. On the other hand, if there is insufficient profit or loss, the Board of Directors may postpone the payment of dividends. The equity shares get dividends at fluctuating rates.

3) Rights:

Equity Shareholders enjoy certain rights :

a) Right to vote: It is the basic right of equity shareholders through which they elect directors, alter Memorandum and Articles of Association, etc.

b) Right to share in profit: It is an important right of equity shareholders. They have right to share in profit when distributed as dividends.

c) Right to inspect books: Equity shareholders have right to inspect statutory books of their company.

d) Right to transfer shares: The equity shareholders enjoy the right to transfer shares as per the procedure laid down in the Articles of Association.

4) No preferential right:

Equity shareholders do not enjoy preferential right in respect of payment of dividend. They are paid dividend only after dividend on preference shares has been paid.

Similarly, at the time of winding up of the company, the equity shareholders are paid last. Further, if no surplus amount is available, equity shareholders will not get anything.

5) Controlling power:

The control of the company is vested with the equity shareholders. They are often described as ‘real masters’ of the company. It is because they enjoy exclusive voting rights. The Act provides the right to cast vote in proportion to shareholding. They can exercise their voting right by proxies, without even attending meetings in person.

6) Risk:

Equity shareholders bear maximum risk in the company. They are described as ‘shock absorbers’ when company has a financial crisis. If the income of company falls, the rate of dividend also comes down.

7) Residual claimant:

Equity shareholders as owners are residual claimants to all earnings after expenses, taxes, etc. are paid. A residual claim means the last claim on the earnings of the company. Although equity shareholders come last, they have the advantage of receiving entire earnings that are left over.

8) No charge on assets:

The equity shares do not create any charge over assets of the company.

9) Bonus Issue:

Bonus shares are issued as gifts to equity shareholders. These shares are issued free of cost to existing equity shareholders. These are issued out of accumulated profits. Bonus shares are issued in proportion to the shares held.

10) Right Issue:

When a company needs more funds for expansion purposes and raises further capital by issue of shares, the existing equity shareholders may be given priority to get newly offered shares. This is called ‘Right Issue’. The shares are offered to equity shareholder first, in proportion to their existing shareholding.

11) Face Value:

The face value of equity shares is low. It can be generally 10 per share or even 1 per share.

12) Market Value:

The market value of equity shares fluctuates according to the demand and supply of these shares. The demand and supply of equity shares depend on profits earned and dividend declared. When a company earns huge profit, market value of its shares increases. On the other hand, when it incurs loss, the market value of its shares decreases.

2. Explain the procedure for issue of debentures.

Answer: Following is the procedure to be followed by a company issuing debentures

1) Pass resolution in Board Meeting:

In the Board Meeting following resolution will have to be passed :

i) amount and type of debentures to be issued and the terms and conditions for issue.

ii) approve prospectus or offer letter or letter of offer.

iii) approve appointment of Debenture Trustees and get their written consent.

iv) authorize Board to create charge on assets of the company.

v) call Extra-ordinary General Meeting if the Board’s borrowing powers need to be increased.

vi) authorizes Board to open a separate bank account for receiving money from applicants.

2) Hold Extra-ordinary General Meeting (EGM):

If the borrowing powers of the Board are to be increased, EGM must be held to get the shareholders’ approval through a Special Resolution.

3) Filing with Registrar of Companies:

Secretary has to file the Special resolution and copy of Prospectus, offer letter / Letter of offer with Registrar of Companies within 30 days of Board Meeting.

4) Obtain Credit Rating:

Company gets its debentures rated by one or more Credit Rating Agencies. The ratings must be mentioned in the prospectus/offer letter/Letter of offer.

5) Enter into underwriting agreement:

Company enters into an underwriting agreement for underwriting its debenture issue.

6) Issue prospectus/letter of offer/offer letter:

Company issues prospectus if it is inviting the public to buy its debentures. Offer Letter is issued if a company makes private placement and Letter of offer for Rights Issue.

7) Open Separate Bank Account:

Company opens a separate bank account in a scheduled Bank to receive the money from the applicants.

8) Receiving application money:

Subscribers will submit their application along with the required amount to the specified bank within the time period mentioned in the prospectus or letter of offer / Offer Letter.

9) Hold Board Meeting:

After the issue closes, a Board Meeting is held to decide and approve allotment of debentures. Board also approves creation of charges on the company’s assets.

10) Issue of Debenture certificate:

The allotment procedure has to be completed within 60 days from the receipt of application money. Company has to issue Debenture certificate within 6 months of allotment of debentures.

11) Make entries in the Register of Debenture holders:

The secretary has to make entries in the Register of Debenture holders within 7 days after the Board’s approval of allotment. However, if debentures are issued in demat form, company does not maintain the Register of Debenture holders.

Check out other posts related to the 12th Commerce

Online lectures of Class 12 Commerce

🔗 Share our videos and channel with your friends, and help us grow this channel.

Learn the Chapters of Accounts from our playlist.

![12th Marathi Paper Pattern Maharashtra Board (2025-26) [Download free pdf] 11 12th Marathi Paper Pattern](https://scholarsclasses.com/blog/wp-content/uploads/2021/10/12th-Marathi-Paper-Pattern--520x245.jpg)