Difference Between Primary and Secondary Market (5 Points) | Important Article

Table of Contents

Difference Between Primary and Secondary Market

Meaning of Primary Market

In Primary market, companies sell their shares, Debentures, etc. for the first time to raise fresh capital. It exclusively deals with the issue of new securities, i.e. securities that are issued to investors for the very first time. Hence this market is also known as New Issues Market.

The main function of the primary market is to facilitate capital formation. It is a place where investors can invest their surplus funds profitably and companies can raise capital easily. On the basis of type of funds raised, Primary market can be classified as Equity market and Debt market. In Equity market, securities like Equity shares, Preference Shares, Rights Issue, etc. are issued. In Debt market, debentures, bonds, fixed deposits, etc. are issued.

Meaning of Secondary Market

The secondary market is more commonly known as the stock market or the stock exchange. Here the previously issued securities are bought and sold by the investors. After IPO, when the shares are listed at the Stock Exchange, they can be traded in the secondary market. In this market, the securities are traded between investors.

The main difference between the primary and the secondary market is that in the primary market only new securities are issued, whereas in the secondary market the already existing securities are traded. There is no fresh issue in the secondary market.

- Difference Between Fixed Capital and Working Capital

- Difference Between Owned Capital and Borrowed Capital

- Difference Between Debenture and Share

- Difference Between Preference Shares and Equity Shares

Difference Between Primary and Secondary Market

| Points | Primary Market | Secondary Market |

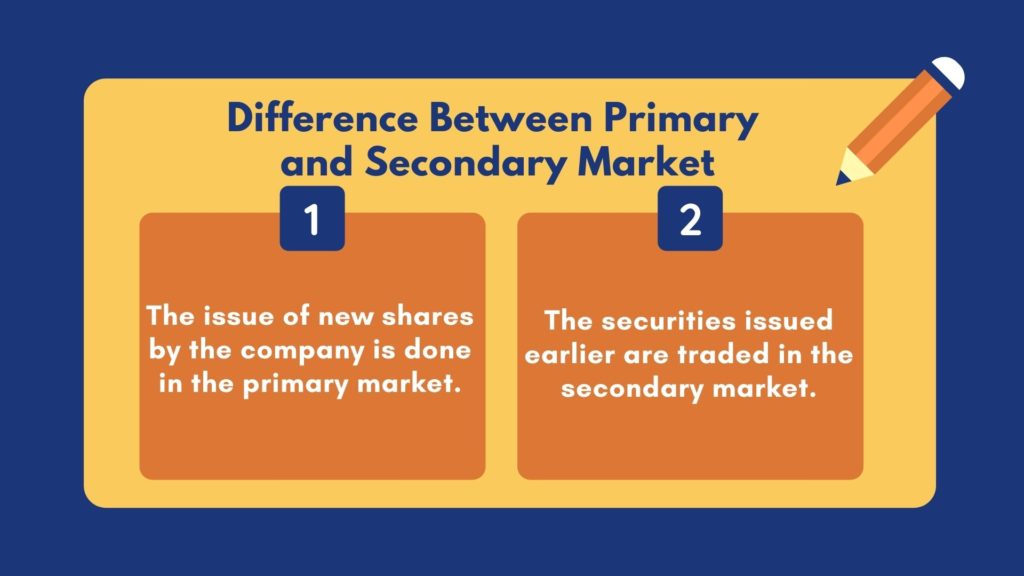

| 1) Meaning | The issue of new shares by the company is done in the primary market. | The securities issued earlier are traded in the secondary market. |

| 2) Mode of Investment | Direct investment in the securities. Securities are acquired directly from the company. | Indirect investment as the securities are acquired from other stakeholders. |

| 3) Parties in action | The parties dealing in this market are company and investors. | The parties dealing in this market are only investors. |

| 4) Intermediary | The underwriters are the intermediaries. | The security brokers are the intermediaries. |

| 5) Value of security | The price of security in the primary market is fixed as it is decided by the company. | The price of security is fluctuating, depending on the demand and supply conditions in the market. |

- Difference between Dematerialisation and Rematerialisation

- Difference Between Final Dividend and Interim Dividend

- Difference Between Dividend and Interest

- Difference Between Primary and Secondary Market

Learn the chapters on TYBCOM from our YouTube channel.