Share Capital Types – Scholarszilla

Table of Contents

Share Capital Types

What is Share Capital?

Share capital refers to the capital made up of Equity Shares and Preference Shares. Usually, in share capital, the proportion of Equity shares is more than Preference shares.

Share Capital Types

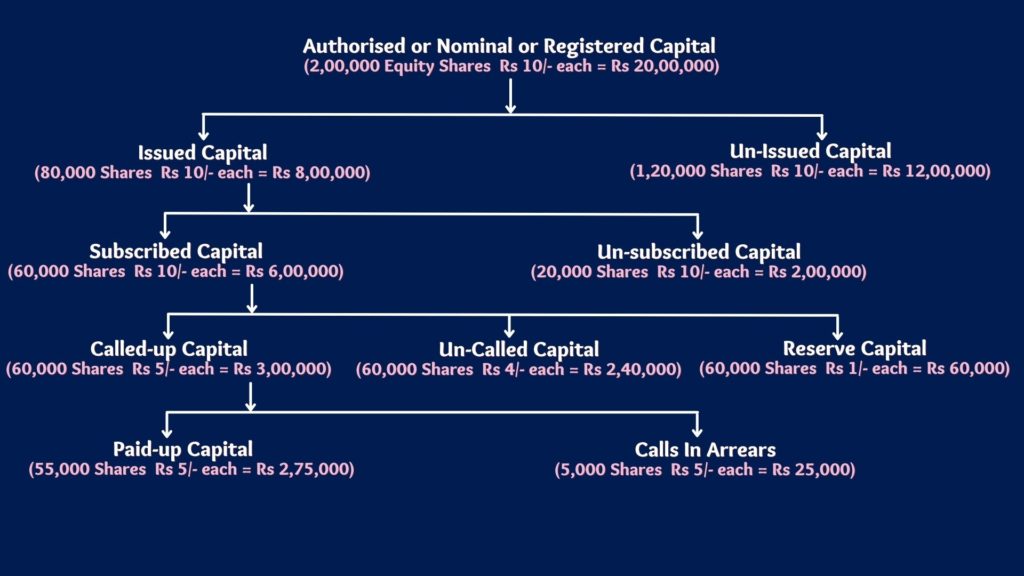

A. Authorised/Nominal or Registered Capital

Authorized Capital is the maximum capital authorized by the Memorandum of Association that a company can raise by issuing shares. It is also called as Registered Capital as it is mentioned in the capital clause of Memorandum of Association and the company pays stamp duty on this amount at the time of incorporation.

Authorized Capital is calculated considering the need for the capital of a company at present and in the future.

Authorized Capital is also called as Nominal Capital as usually a company never issues the entire Authorised Capital.

e.g. ‘M’ Ltd. The company has an Authorised Capital of Rs 20,00,000 which can be divided into 2,00,000 Equity shares having a face value of Rs 10 each. A company can increase its Authorised capital by altering its Memorandum of Association.

B. Issued and Unissued Capital

Issued Capital is that part of Authorised Capital which is offered by the company to prospective investors for a subscription. Thus, it is the shares that the company is offering to the public to buy.

The balance part of Authorised capital not offered to the public is called as ‘Unissued Capital’. In future, the company can issue shares from the unissued capital.

The issued capital of a company may be equal to or less than the Authorised Capital.

e.g. ‘M’ Ltd. Company can have an Issued Capital of Rs 8,00,000 divided into 80,000 Equity shares at face value of Rs 10/- each and the unissued capital will be Rs 12,00,000 divided into 1,20,000 Equity shares of 10/- each.

C. Subscribed and Unsubscribed Capital

Subscribed capital is that part of Issued-capital which has been subscribed or taken up (bought) by investors (subscriber). The public may or may not subscribe for the entire Issued capital. Hence, that part of the Issued capital not subscribed by the investors is called as ‘unsubscribed capital’. Thus, the subscribed capital may be equal to or less than the Issued capital.

e.g. If ‘M’ Ltd. Company has Issued capital of Rs 8,00,000 i.e. has issued 80,000 Equity shares, then the company’s subscribed capital can be Rs 6,00,000 divided into 60,000 Equity shares of Rs 10/- each. Hence, the unsubscribed capital will be Rs 2,00,000 divided into 20,000 Equity shares of Rs 10/- each.

D. Called-up Capital, Uncalled Capital and Reserve Capital

At the time of the Issue, full value of the shares is usually not demanded by the company. The company collects the full value of shares in installments as per its requirement of funds. Each Instalment is called as ‘calls’. Called-up capital is that part of subscribed capital that a company has ‘called’ or demanded to be paid by the shareholders.

The balance capital which is not demanded from the shareholders is called as uncalled capital.

Reserve Capital is a part of uncalled capital. A company can decide to keep aside a part of its uncalled capital to be called up only at the time of winding up of a company to meet its financial requirements.

e.g. ‘M’ Ltd. Company may have called up capital of Rs 3,00,000 i.e. 60,000 Equity shares of face value of Rs 10/- each out of which Rs 5/- per share has been called up/demanded by the company.

If the company decides to keep Re. 1/- per share as capital to be collected at the time of the winding up, the Reserve Capital will be Rs 60,000 i.e. 60,000 equity shares of Rs 10 each where Re. 1 per share is kept as Reserve Capital.

Uncalled capital will be Rs 2,40,000 i.e. 60,000 Equity shares where Rs 4 per share which will be called up in future.

E. Paidup Capital and Calls in Arrears

Paid-up capital is the total amount of money actually paid up by the shareholders when the company has called up or demanded them to pay.

The amount not paid up by the shareholders is called up as Calls in Arrears or unpaid calls.

Every shareholder has to pay calls as and when the company demands. Failure to pay the calls may lead to the forfeiture of shares.

e.g. ‘M’ Ltd. company has made a call of 5 per share, so if all the shareholders have paid the calls, then the paid up capital will be Rs 3,00,000 (60,000 Equity shares Rs 5/- per share). But if for e.g. 5,000 Equity shares calls are not paid then the paid up capital will be 2,75,000 (55,000 Equity shares of Rs 5/- per share) and Calls-in-Arrears will be Rs 25,000 (5,000 Equity shares of RS 5/- per share)