Types of Cost in Cost Accounting | Classification of Cost – Free Articles

Table of Contents

Types of Cost

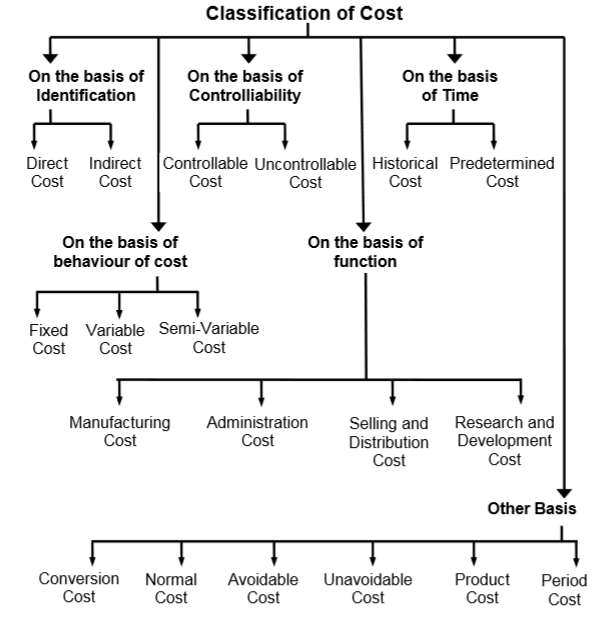

Classification is the process of grouping costs according to their common characteristics. It is a systematic arrangement of like items together according to their common features. There are various ways of classifying costs, according to their common features below.

A) Types of Cost On the basis of Identification

On the basis of identification of cost with cost units or jobs or processes, costs are classified into–

1) Direct Costs

These are the costs that are incurred for and conveniently identified with a particular cost unit process or department. These are the expenditures that can be directly allocated to a particular job, product or activity. E.g. Cost of Raw Material used, wages paid to labourers etc.

2) Indirect Costs

These are general costs and are incurred for the benefit of a number of cost units, processes or departments. These costs can not be conveniently identified with a particular cost unit or cost centre. Example: Depreciation of Machinery, Insurance, Lighting, Power, Rent of Building, Managerial Salaries, etc.

B) Types of Cost On the basis of the behaviour of Cost

Behaviour means a change in cost due to a change in output. Costs behave differently when the level of production rises or falls. Certain costs change in direct proportion with production level while other costs remain unchanged. As such on the basis of the behaviour of cost– costs are classified into

1) Fixed Costs

It is that portion of the total cost which remain constant irrespective of output upto the capacity limit. It is the cost that does not vary with the change in the volume of activity in the short run. These costs are not affected by temporary fluctuation in the activity of an enterprise. These are also known as period costs as it is concerned with period. Rent of premises, tax and insurance, staff salaries, are examples of fixed costs.

Characteristics of Fixed Cost are :

a) Large in value

b) Fixed amount within an output range

c) Fixed cost per unit decreases with increased output

d) Indirect Cost

e) Lesser degree of controllability

f) Influence Variable Cost and Working Capital

2) Variable Cost

It is that cost that directly varies with the volume of activity. In other words, it is a cost that changes according to the changes in the volume of output. It tends to be varied in direct proportion to output. It means when the volume of output increases, total variable cost also increases when the volume of output decreases, total variable cost also decreases. But the variable cost per unit remains the same. Direct material, Direct Labour, Direct Expenses are examples of variable costs.

Characteristics of Variable Cost are :

a) Total cost changes in direct proportion to the change in total output.

b) Cost per unit remains content.

c) It is quite divisible.

d) It is identifiable with the individual cost unit.

e) Such costs are controlled by the functional manager.

3) Semi-Variable Cost

This is also referred to as semi-fixed costs. These costs include both a fixed and a variable component. i.e. These are partly fixed and partly variable. They remain constant upto a certain level and registers change afterwards. These costs vary to some degree with volume but not in direct or same proportion. Such costs are fixed only in relation to specified constant conditions.

For example Repairs and maintenance of machinery, telephone charges, maintenance of building, supervision,

professional tax, compensation for accidents, light and power etc.

C) Types of Cost On the basis of Controllability

Based on controllability, costs are classified into two types :

1) Controllable Cost

These are the costs that can not be influenced or controlled by the concerned cost centre or responsibility centre. These costs may be directly regulated at a given level of management authority.

2) Uncontrollable Cost

These are the costs, which can not be influenced or controlled by the action of a specific member of an enterprise. For eg., it is very difficult to control costs like factory rent, managerial salaries etc.

The important points to be noted regarding this classification. First, the controllable costs can not be distinguished from non-controllable costs, without specifying the level and scope of management authority. It means cost which is uncontrollable at one level of management may be controllable at another level of management. Eg. Rentand Factory Building may be beyond control for the production department but can be controlled by the administrative department by negotiations. Secondly, all costs are controllable in the long run and at some appropriate management level.

D) Types of Cost On the basis of Functions

An organisation performs many functions. Based on functions costs can be classified as follows:

1) Manufacturing Costs

It is the cost of all items involved in the manufacturing of a product or service. It includes all direct costs and all indirect costs related to the production. It includes the cost of direct materials, direct labour, direct expenses, and overhead expenses related to production. Overhead expenses, means all

indirect costs involved in the production process. This is termed as factory overhead or manufacturing overheads. Eg. Salaries of staff for the production department, technical supervision, Expenses of stores department, Depreciation of Plant and Machinery, Repairs and maintenance of Factory Building and Machinery etc.

2) Administration Cost

These are costs incurred for the general management of an organisation. It is the cost that is incurred for formulating the policy, directing the organisation of controlling the operations. These are in the nature of indirect costs and are also termed as administrative overhead. Eg. Salaries of Administrative Stall, General Office expenses like rent, lighting, telephone, stationery, postage etc.

3) Selling and Distribution Costs

Selling costs are the indirect costs relating to selling of products or services. They include all indirect cost in sales management for the organisation. Selling costs include all expenses relating to regular sales and sales

promotion activities. Examples of expenses that are included in selling costs are :

- Salaries, Commissionand traveling expenses for sales personnel

- Advertisement cost

- Legal Expenses for debt realization

- Market research cost

- Show room expenses

- Discount allowed

- Sampleand free gifts

- Rent on Sales room

- After sale services

Distribution costs are the costs incurred in handling a product from the time it is completed in the works until it reaches the ultimate consumer. Distribution expenses include all these expenses which are incurred in connection with making the goods available to customers. These expenses include the following.

- Packing charges

- Loading charges

- Carriage on Sales

- Rent of warehouse

- Insuranceand lighting of warehouse

- Transportation costs

- Salaries of godown keeper, driver, packing staff etc.

4) Research and Development Cost

Research and development costs are incurred to discover new ideas, processes, products by experiment. It includes the cost of the process which begins with the implementation of the decision to produce or improve the product.

E) Types of Cost On the basis of Time

On the basis of time of computation, costs are classified into historical costs and predetermined costs.

1) Historical Costs

These are the costs that are ascertained after these have been incurred. Historical costs are then nothing but actual costs. They represent the costs of actual operational performance. These costs are not available until after the completion of manufacturing operations.

2) Predetermined Costs

These are the future costs that are ascertained in advance of production on the basis of a specification of all the factors affecting cost and cost data. Predetermined costs are future costs determined in advance on the basis of standards or estimates. These costs are extensively used for the purpose of planning and control.

E) Types of Cost On other Basis

1) Normal Cost

Normal cost may be defined as a cost that is normally incurred on expected lines at a given level of output, in the condition in which that level of output is normally attained. This cost is a part of the production.

2) Abnormal Cost

Abnormal cost is that cost that is not normally incurred at a given level of output, in the condition in which that level of output is normally attained. Such cost is over and above the normal cost and is not treated as a part of the cost of production.

3) Avoidable Cost

The cost which can be avoided under the present condition is an avoidable cost. These are the costs that under given conditions of performance efficiency should not have been incurred. They are logically associated with some activity and situation and are ascertained by the difference of actual cost with the happening of the situation and the normal cost. Eg. when spoilage occurs in manufacturing in excess of the normal limit, the resulting cost of spoilage is an avoidable cost.

4) Unavoidable Cost

The cost which can not be avoidable under the present condition is an unavoidable cost. They are inescapable costs that are essential to be incurred within the limits or norms provided for. It is the cost that must be incurred under a programme of business restriction.