HSC SP Question Paper 2021 with Solution | Maharashtra Board (Download Free Pdf)

Table of Contents

HSC SP Question Paper 2021 with Solution

- 12th Commerce July 2022 Question Papers – View

- 12th Commerce March 2021 Question Papers – View

- 12th Commerce March 2022 Question Papers – View

Check out other posts related to the 12th Commerce

| Textbook Solutions of 12th Commerce (All Subjects) | Click Here |

| Free pdf of 12th Commerce Textbooks | Click Here |

| 12th Commerce IT MCQ Preparation (Online Test) | Click Here |

| 12th Commerce Paper Pattern and Chapter Wise Marks Distribution | Click Here |

| Sample Paper of 12th Commerce for Practice | Click Here |

| Solved Sample papers of 12th Commerce to improve Paper Presentation | Click Here |

| Old Question Papers of 12th Commerce with solution (All Subjects) | Click Here |

| Chapter Name | Solution Link |

| 1) Introduction to Corporate Finance | Click Here |

| 2) Sources of Corporate Finance | Click Here |

| 3) Issue of Shares | Click Here |

| 4) Issue of Debentures | Click Here |

| 5) Deposits | Click Here |

| 6) Correspondence with Members | Click Here |

| 7) Correspondence with Debentureholders | Click Here |

| 8) Correspondence with Depositors | Click Here |

| 9) Depository System | Click Here |

| 10) Dividend Interest | Click Here |

| 11) Financial Market | Click Here |

| 12) Stock Exchange | Click Here |

HSC SP Question Paper 2021 with Solution

Q. 1. (A) Complete the sentences :(5) {20}

1) The oldest Stock Exchange in India is the _____. (Bombay Stock Exchange)

2) The finance needed by the business organization is termed as _____. (Capital)

3) Dividend is paid to _____. (Registered shareholders)

4) The Indian Depositor Act was passed in the year _____. (1996)

5) The obligatory payment made by a company to its creditors is called as _____. (Interest)

(B) Match the correct pairs of words from group ‘A’ and group ‘B’ :(5)

| Group ‘A’ | Group ‘B’ |

| a) Fixed Capital | 1) Offered to existing equity shareholders |

| b) ESPS | 2) Custodian of securities in electronic form |

| c) Interim Dividend | 3) To protect the interest of investors in the securities market |

| d) Depository | 4) Fixed Assets |

| e) SEBI | 5) Decided and declared by the Board of Directors |

| 6) Offered to existing employees | |

| 7) To protect the interest of companies in the securities market | |

| 8) Problems faced in electronic mode | |

| 9) Decided by Board and declared by members | |

| 10) Fixed Liabilities |

Answer

A-4 , B-6 ,C-5 ,D-2 ,E-3

(C) Correct the underlined word and rewrite the following sentences :(5)

1) Bond is a source of short term finance. (Long)

2) In Primary market, already existing securities are traded. (Secondary)

3) Securities are fungible in Physical mode. (Electronic)

4) Preference shareholders get dividend from residual profits. (Equity)

5) In Money market, the instruments traded have maturity period of more than one year. (Capital)

(D) Find the odd one : (5)

1) Final Dividend, Interim Dividend, Interest.

2) Bonus shares, Right shares, ESOS.

3) Dividend, Depositor, Depositor receipt.

4) DP, BO, State government.

5) Debenture trustees, Trust Deed, Shareholders.

Q. 2. Explain the following terms/concepts : (Any Four) (12)

1) Owned Capital

Answer: a)The capital raised by company with the help of owners (shareholders) is called owned capital

or ownership capital. The shareholder’s purchase shares of the company and supply necessary capital. It is one form of owned capital.

b) Another form of owned capital is retained earnings. It is also known as ploughing back of profit. It is a reinvestment of profit in the business b the company itself. Retained earnings is an internal source of finance.

c) Owned capital is regarded as permanent capital, as it is returned only at the time of winding up of the company.

2) Minimum Subscription

Answer: Minimum subscription is the minimum amount of shares that must be taken or bought by the subscribers. This amount is mentioned in the prospectus. It must be collected within thirty (30) days from the issue of the prospectus. SEBI has stated minimum subscription should be 90% of the issue.

3) Charge on assets

Answer: Company has to create a charge on the assets of the company or its subsidiary company or holding company. The value of the charge should be adequate to cover the entire value of debentures issued and the interest to be paid on it. If a Government company issues secured debentures which has a Central or State Government guarantee, then it need not create any charge on its assets.

4) Secured Deposits

Answer: a) A company can accept secured or unsecured deposits which should be clearly mentioned in the circular or advertisement inviting deposits.

b) If a company offers secured deposits, it has to create a charge on its tangible assets within 30 days of acceptance of deposits.

c) When issuing secured deposits, eligible companies and public companies have to appoint one or more Deposit Trustees.

d) A company accepting secured deposit from the public, within thirty days of acceptance, has to create a charge on its tangible assets for an amount not less than the amount of deposit accepted.

5) Correctness

Answer: a) Correctness means that the details of a message are accurate. Details involve not only the message content but also the message appearance.

b) Always ensure the message you communicate is correct to the best of your knowledge.

c) Your receivers invest precious time in listening or reading your message because they feel that the message you communicate is reliable and if they find it otherwise, you lose your credibility.

6) Stock Exchange

Answer: a) Stock exchange is a specific place where various types of securities are purchased and sold.

b) The term securities include equity shares, preference shares, debentures, government securities, and bonds, etc. including units of Mutual Funds.

c) Stock markets act as intermediaries between investors and borrowers.

d) According to the Securities Contracts (Regulation) Act 1956, the term stock exchange is defined as, “An association, organization or body of individuals, whether incorporated or not, established for the purpose of assisting, regulating and controlling of business in buying, selling and dealing in securities.”

Q. 3. Study the following case/situation and express your opinion : (Any Two) (6)

(1) Violet Ltd. company plans to raise Rs 10 crores by issuing debentures. The Board of Directors has some queries. Please advise them on the following:

a) Can the company issue Convertible debentures?

Answer: Yes, public limited company can issue convertible debentures.

b) Can they issue irredeemable debentures?

Answer: No, A company cannot issue irredeemable debentures as such debentures are not giving undertaking to repay.

c) As the company is offering debentures to its members, can such debentures have normal voting rights?

Answer: Debenture holders are the creditors of the company, therefore they do not have normal voting rights.

(2) SUN Pvt. Ltd. company wants to raise funds through deposits :

a) Can the company accept deposits from the public?

Answer: No, the company cannot accept deposits from the public. because Sun Pvt. Ltd. is a private company and it cannot accept deposits from the public.

b) Which document should the company issue to invite deposits?

Answer: Sun Pvt. Ltd. is a private company. therefore it should issue a circular to invite deposits from its members.

c) What is the maximum period for which they can accept deposits?

Answer: The maximum period for which they can accept deposits is 36 months.

(3) Mr. Arnav holds 100 shares of Peculiar Co. Ltd. in Physical mode and wishes to convert the same in electronic mode :

a) Mr. Arnav holds a Saving Bank Account with CFDH Bank Ltd. Can he deposit his shares in this account for Demat?

Answer: No, Mr. Arnav cannot deposit his shares in his bank account for Demat.

b) What type of account is needed for the same?

Answer: A Demat account is needed to convert physical shares into electronic shares.

c) Is it the RBI that will be the custodian of shares of Mr. Arnav after demating?

Answer: No, RBI cannot act as the custodian of shares of Mr. Arnav The bank can act as a custodian.

Q. 4. Distinguish between the following : (Any Three) (12)

1) Equity shares and Preference shares.

| Points | Equity shares | Preference shares |

| 1) Meaning | Shares that are not preference shares are called equity shares i.e. these shares do not have preferential right for payment of dividend and repayment of capital. | Preferences shares are Shares that carry preferential rights as to payment of : a) Dividend and b) Repayment of capital. |

| 2) Rate of Dividend | Equity shares are given dividend at a fluctuating rate depending upon the profits of the company. | Preference shareholders get dividend at a fixed rate. |

| 3) Voting Right | Equity shareholders enjoy normal voting rights. They participate in the management of their company. | Preference shareholders do not enjoy normal voting right. They can vote only on matters affecting their interest. |

| 4) Return of Capital | Equity capital can not be returned during the lifetime of the company. (except in case of buy back) | A company can issue redeemable preference shares, which can be repaid during the lifetime of the company. |

| 5) Nature of capital | Equity capital is known as ‘Risk Capital.’ | Preference capital is ‘Safe Capital’ with stable return. |

| 6) Nature of investor | The investors who are ready to take risk invest in equity shares. | The investors who are cautious about safety of their investment, invest in preference shares. |

| 7) Face value | The face value of equity shares is generally Rs 1/- or Rs 10/- it is relatively low. | The face value of preference shares is relatively higher i.e. 100/- and so on. |

| 8) Right and bonus issue | Equity shareholder is entitled to get bonus and right issue. | Preference shareholders are not eligible for bonus and right issue. |

2) Transfer of Shares and Transmission of Shares

| Points | Transfer of Shares | Transmission of Shares |

| 1) Meaning | Transfer of shares means voluntarily or deliberately giving away one’s shares to another person by entering into a contract with the buyer. | It means a transfer of ownership of a member’s shares to his legal representative due to operation of law. It takes place on death, insolvency or insanity of the members. |

| 2) When done | It is done when the member wants to sell his shares or give his shares as gift. | It is done when the member dies or becomes insolvent or insane. |

| 3) Nature of Action | It is a voluntary action taken by the member. | It is an involuntary action. It is due to operation of law. |

| 4) Parties involved | In transfer of shares, there are two parties involved- the member who is called as transferor and the buyer who is called as transferee. | There is only one party e.g. the nominee of the member in case of death of the member or the legal representative. |

| 5) Instrument of transfer | Transfer requires an Instrument of transfer. It is a contract between the transferor and transferee. | No Instrument of transfer is needed. |

| 6) Initiated by | Transferor initiates the transfer process. | Legal representative or official receiver initiates the process of transmission. |

| 7) Consideration | Transfer of shares is done often by the member to receive some consideration (money) i.e. the buyer has to pay for the shares. (Except given as gift.) | No consideration is involved here. The legal heir or official receiver need not pay for the shares. |

| 8) Liability | The liability of the transferor ends after the shares are transferred. | Original liability of the member continues in case of transmission of shares. |

| 9) Stamp Duty | Stamp duty as per the market value of shares has to be paid. | No stamp duty is to be paid |

3) Dividend and Interest

| Points | Dividend | Interest |

| 1) Meaning | Dividend is the return payable to the shareholders of the company for their investment in the share capital. | It is the return payable to the creditors of the company viz. Debenture holder / Deposit holders for the loan given b them to the company. |

| 2) Given to whom | It is paid to the member i.e. the owners of the company. | It is paid to the creditor of the company. |

| 3) Obligation | It is to be paid only when company has made profits. Therefore no obligation / compulsion to pay dividend. | It is not linked to the profits of the company. Payment of interest is an obligation and is to be paid b the company compulsorily. |

| 4) When Payable | It is payable when a company earns sufficient profit in a year after fulfilling all obligations. | It is payable every year irrespective of the profits of the company. |

| 5) Rate | It is paid at a fluctuating rate to the equity shareholders since it is linked to the profits of company. | Rate of interest is fixed and pre- determined at the time of issue of the security. |

| 6) Resolution | Payment of Final Dividend requires a Board resolution and an ordinary resolution at the AGM while Interim Dividend can be paid b passing only a Board Resolution. | Payment of interest does not require passing of a resolution at any meeting. |

| 7) Accounting Treatment / Aspect | Dividend is an appropriation of profit. | Interest is a charge on profit. |

4) Primary market and Secondary market

| Points | Primary Market | Secondary Market |

| 1) Meaning | The issue of new shares by the company is done in the primary market. | The securities issued earlier are traded in the secondary market. |

| 2) Mode of Investment | Direct investment in the securities. Securities are acquired directly from the company. | Indirect investment as the securities are acquired from other stakeholders. |

| 3) Parties in action | The parties dealing in this market are company and investors. | The parties dealing in this market are only investors. |

| 4) Intermediary | The underwriters are the intermediaries. | The security brokers are the intermediaries. |

| 5) Value of security | The price of security in the primary market is fixed as it is decided by the company. | The price of security is fluctuating, depending on the demand and supply conditions in the market. |

Q. 5. Answer the following questions in brief : (Any Two) (8)

1. State any four factors affecting fixed capital requirement.

Answer: Fixed capital is the capital that is used for buying fixed assets that are used for a longer period of time in the business. These assets are not meant for resale.

Factors affecting fixed capital requirement:

1) Nature of business:

Manufacturing industries and public utilities have to invest huge amount of funds to acquire fixed assets. While Trading business may not need huge investments in fixed assets.

2) Size of business:

Where a business firm is set up to carry on large scale operations, its fixed capital requirements are likely to be high. It is because most of their production processes are based on automatic machines and equipment.

3) Scope of business:

There are business firms which are formed to carry on production or distribution on a large scale. Such businesses would require more amount of fixed capital.

4) Extent of lease or rent:

If an entrepreneur decides to acquire assets on lease or on rental basis, less amount of funds for fixed assets will be needed for the business.

5) Arrangement of sub-contract:

If the business wants to sub-contract some processes of production to others, limited assets are required to carry out the production. It would minimize fixed capital requirement of business.

2. State any four provisions of Companies Act 2013 for issue of debentures.

Answer: The following are some of the provisions of the Act which a company has to comply while issuing debentures:

1) No voting rights:

A company cannot issue debentures with voting rights. Debenture holders are creditors of the company and so they do not have any voting rights except in matters affecting them.

2) Types of Debentures:

A company can issue secured or unsecured debentures and fully or partly convertible debentures or non-convertible debentures. To issue convertible debentures, a Special Resolution has to be passed in the General Meeting. All debentures are redeemable in nature.

3) Payment of interest and redemption:

A company shall redeem the debentures and pay interest as per the terms and conditions of their issue.

4) Debenture Certificate:

The company has to issue Debenture certificate to the debenture holders within 6 months of allotment of Debentures.

5) Create Debenture Redemption Reserve:

Company has to create a Debenture Redemption Reserve account out of profits of the company available for payment of dividend. This money can be used only for redemption of debentures. As per companies (Share Capital and Debentures) Amendment Rules 2019, MCA has removed Debenture Redemption Reserve requirement for Listed companies, NBFCs and Housing Finance Companies.

3) Explain any four advantages of Depository System to investors.

Answer: Under Depositor System, securities are held in electronic form. The transfer and settlement of securities are done electronically. The Depositor System maintains accounts of the shareholder, enables transfer, collects dividends, bonus shares, etc. on behalf of the shareholder. This system is also called as scripless trading system.

Advantages of Depository System to Investors

1) Elimination of Risk:

All risks associated with physical certificates like delays, lost, theft, mutilation, bad deliveries, etc. are totally eliminated.

2) Safety:

It is the safest and secure way of holding securities. The entire system functions under the Depositor Act and is monitored by SEBI. e.g. The Investor can keep his account in a ‘Freeze / Lock’ mode to avoid/prevent unexpected debit or credit or both by giving instructions to the DP.

3) Easy Transfer of shares:

(a) Efforts in filling transfer forms and lodging the documents are eliminated.

(b) Also the stamp duty levied on transfer of physical shares is not applicable.

(c) Processing time in transfer of securities is reduced and neither the securities nor the cash is tied/held up for an unnecessarily long time.

4) Updates and Intimation:

The investor is provided with the status of the holdings and transactions by DP and occasionally by the Depository too.

5) Security against Loan:

Dematerialized securities are preferred by banks and financial institutions as security against loan.

Q. 6. Justify the following statement : (Any Two) (8)

1) Bondholder is creditor of the company.

Answer:

1) A bond is an interest-bearing certificate issued by the government or business firm, promising to pay the holder a specific sum at a specified date.

2) Bond is a debt security. It is a formal contract to repay borrowed money with interest.

3) Thus a company borrows money and issues bonds as evidence of debt.

4) Interest is payable on bonds at a fixed interval or on the maturity of bonds.

5) The holder of the bond is a lender to the institution. He gets a fixed rate of interest.

Thus, the Bondholder is a creditor of the company.

2) A company has to create charge on its assets for issuing secured debentures.

Answer:

a) A company has to create charge on its assets for issuing secured debentures that can be justified by following points.

b) Company has to create a charge on the assets of the company or its subsidiary company or holding company.

c) The value of charge should be adequate to cover the entire value of debentures issued and interest to be paid on it.

d) If a Government company issues secured debentures which has Central or State Government’s guarantee,

then it need not create any charge on its assets.

Thus, A company has to create charge on its assets for issuing secured debentures.

3) Approval of members is not needed for Interim Dividend.

Answer:

a) Dividend declared by the Board of Directors between two Annual General Meetings is called Interim Dividend.

b) It is paid in the middle of the accounting year. It is declared out of profits of the current account year.

c) The Board of Directors has the power to declare Interim Dividend.

d) Articles of Association’ of the Company must authorize the Board of Directors to declare an interim dividend.

e) The Board Meeting has to pass a resolution for declaring the Interim dividend.

Thus, it is rightly said that approval of members is not needed for Interim dividends.

4) The Securities and Exchange Board of India (SEBI) is the regulator for the securities market in India.

Answer:

a) The Securities and Exchange Board of India (SEBI) is the regulator of the capital markets in India. The SEBI was established in 1992 under the Securities and Exchange Board of India Act, 1992.

b) SEBI was set up with the objective of promoting the securities market, protecting the interest of the investors in securities market, and regulating the securities market.

c) SEBI issues rules and regulations to be followed by the issuers of securities, the market intermediaries, and the investors. It is a regulator of all the Stock exchanges in India.

d) SEBI also regulates the working of venture capital funds and collective investment schemes including mutual funds.

Thus, the Securities and Exchange Board of India (SEBI) is the regulator for the securities market in India.

Q. 7. Attempt the following : (Any TWO) (10)

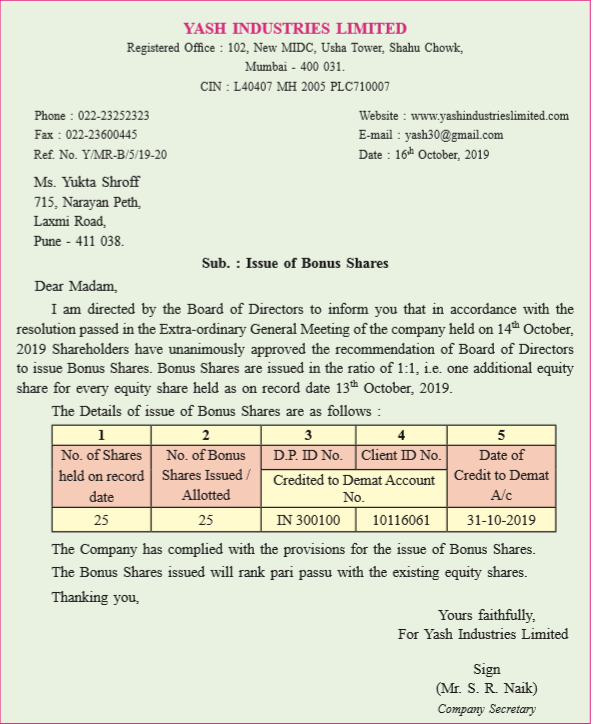

1) Write a letter to the shareholder regarding issue of Bonus Shares.

Answer:

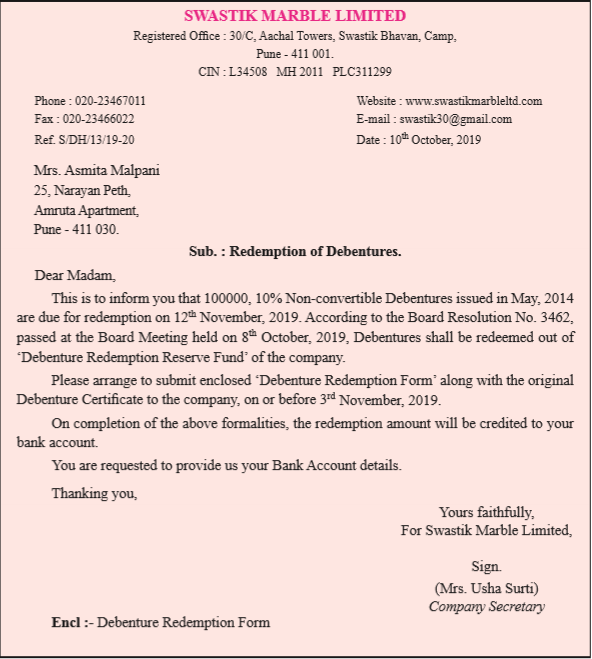

2) Draft a letter to debentureholder informing him/her about redemption of debentures.

Answer:

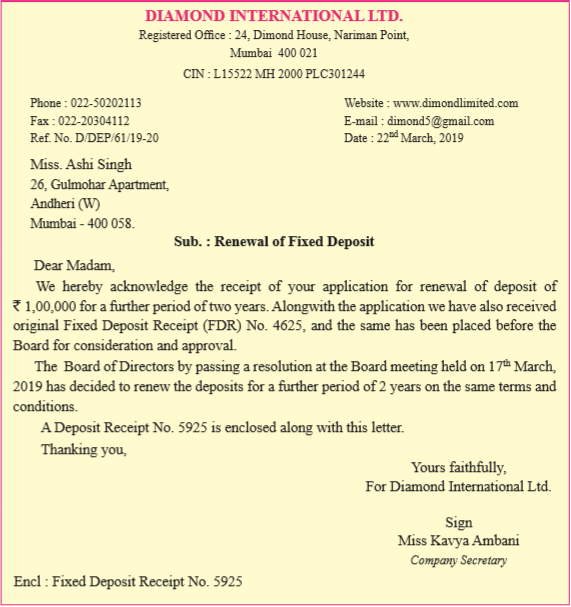

3) Write a letter to depositor regarding renewal of his/her deposit.

Answer:

Q. 8. Answer the following questions : (Any One) (8)

1. What is Debenture? Discuss the different types of debentures.

Answer:

Debentures are one of the principal sources of raising borrowed capital to meet long and medium term financial needs.

The term debenture has come from the latin word ‘debere’ which means to ‘owe’.

The term debenture has not been defined clearly under Companies Act.

Sec 2(30) of the Companies Act 2013, only states that, ‘the word debenture includes debenture stock, bonds and any other instrument of a company evidencing a debt, whether constituting a charge on the assets of the company or not’.

Types of Debentures

1) Secured debentures:

The debentures can be secured. The property of company may be charged as security for loan. The security may be for some particular asset (fixed charge) or it may be the asset in general (floating charge). The debentures are secured through ‘Trust Deed’.

2) Unsecured debentures:

These are the debentures that have no security. The issue of unsecured debentures is now prohibited b the Companies Act, 2013.

3) Registered Debentures:

Registered debentures are those debentures on which the name of holders are recorded. A company maintains ‘Register of Debentureholders’ in which the name, address and particulars of holdings of debentureholders are entered.

4) Bearer Debentures:

The names of holders are not recorded on the bearer debentures. Their names do not appear on the ‘Register of Debentureholders’. Such debentures are transferable b mere delivery. Payment of interest is made by means of coupons attached to debenture certificate.

5) Redeemable Debentures:

Debentures are mostly redeemable i.e. Payable at the end of some fixed period, as mentioned on the debenture certificate. Repayment can be made at fixed date at the end of specific period or by installment during the life time of the company. The provision of repayment is normally made in ‘Trust Deed’.

6) Irredeemable Debentures:

These kind of debentures are not repayable during life time of the company. The are repayable only after the liquidation of the company, or when there is breach of any condition or when some contingency arises.

7) Convertible Debentures:

Convertible debentures give right to holder to convert them into equity shares after a specific period of time. Such right is mentioned in the debenture certificate. The issue of convertible debenture must be approved b special resolution in general meeting before they are issued to public.

8) Non-convertible Debentures:

Non-convertible debentures are not convertible into equity shares on maturity. These debentures are redeemed on maturity date. These debentures suffer from the disadvantage that there is no appreciation in value.

2. Explain the statutory provisions for allotment of shares.

Answer:

When a company gives shares to an applicant based on the application submitted, it is called as Allotment of Shares.

The company issues prospectus and application form. Applicant (subscribers) fills the form and submits it, with application money to the company’s bankers. The Board of Directors approves the acceptance of such applications in the Board meeting by passing the resolution. This is called as allotment of shares.

Statutory Provisions for Allotment of Shares :

(1) Registration of Prospectus:

A copy of the prospectus must be filed with the Registrar of Companies for registration on or before the date of its publication. This prospectus must be signed by every proposed Director (in case of newly formed company) or director or his duly authorised advocate.

(2) Application Money:

The Companies Act states that along with the application form, the applicant has to pay a minimum of 5% of the nominal amount of the shares or such other amount as specified b SEBI. SEBI has specified (for public companies) the application money to be minimum 25% of the nominal amount of shares.

(3) Minimum Subscription:

Minimum subscription is the minimum amount of shares that must be taken or bought by the subscribers. This amount is mentioned in the prospectus. It must be collected within thirty (30) days from issue of prospectus. SEBI has stated minimum subscription should be 90% of the issue.

(4) Closing of subscription list:

As per SEBI, the subscription list must be kept open for atleast three working days and not more than ten working days. Applicants can apply for shares only when the subscription list is open.

(5) Basis of allotment:

\Allotment of shares will be on the basis which will be decided for each category of subscribers. Allotment will be as per the minimum application size as fixed by the company.

(6) Oversubscription:

Oversubscription means when application received for shares are more than the number of shares offered by the company. SEBI does not allow any allotment in excess of securities offered through offer document or prospectus. However, it may permit to allot not more than 10% of the net offer.

(7) Permission to deal on Stock Exchange:

Every company, before making a public offer shall apply to one or more recognized Stock Exchanges to seek permission for listing its shares with them. The prospectus shall mention the name of the Stock Exchange and the fact that an application for permission to list in that stock exchange has been made by the company.

(8) Appointment of Managers to the issue and various other agencies:

The company has to appoint one or more Merchant Bankers to act as managers to the public issue. It also has to appoint Registrar to the issue, Collecting Bankers, Underwriters to the issue and Brokers to the issue, self-certified syndicate banks, advertising agents etc.

- 12th OCM 2021 Board Papers

- 12th SP 2021 Board Papers

- 12th English 2021 Board Papers

- 12th Accounts 2021 Board Papers

Check out other posts related to the 12th Commerce

| Textbook Solutions of 12th Commerce (All Subjects) | Click Here |

| Free pdf of 12th Commerce Textbooks | Click Here |

| 12th Commerce IT MCQ Preparation (Online Test) | Click Here |

| 12th Commerce Paper Pattern and Chapter Wise Marks Distribution | Click Here |

| Sample Paper of 12th Commerce for Practice | Click Here |

| Solved Sample papers of 12th Commerce to improve Paper Presentation | Click Here |

| Old Question Papers of 12th Commerce with solution (All Subjects) | Click Here |

12th OCM Sample Question Paper

How to write OCM paper in board Exam – Watch Video

sp question papers for practice