12th SP Question Paper 2022 with Solution | Maharashtra Board (Download Free Pdf)

Table of Contents

12th SP Question Paper 2022 with Solution

- 12th Commerce July 2022 Question Papers – View

- 12th Commerce March 2021 Question Papers – View

- 12th Commerce March 2022 Question Papers – View

Check out other posts related to the 12th Commerce

| Textbook Solutions of 12th Commerce (All Subjects) | Click Here |

| Free pdf of 12th Commerce Textbooks | Click Here |

| 12th Commerce IT MCQ Preparation (Online Test) | Click Here |

| 12th Commerce Paper Pattern and Chapter Wise Marks Distribution | Click Here |

| Sample Paper of 12th Commerce for Practice | Click Here |

| Solved Sample papers of 12th Commerce to improve Paper Presentation | Click Here |

| Old Question Papers of 12th Commerce with solution (All Subjects) | Click Here |

| Chapter Name | Solution Link |

| 1) Introduction to Corporate Finance | Click Here |

| 2) Sources of Corporate Finance | Click Here |

| 3) Issue of Shares | Click Here |

| 4) Issue of Debentures | Click Here |

| 5) Deposits | Click Here |

| 6) Correspondence with Members | Click Here |

| 7) Correspondence with Debentureholders | Click Here |

| 8) Correspondence with Depositors | Click Here |

| 9) Depository System | Click Here |

| 10) Dividend Interest | Click Here |

| 11) Financial Market | Click Here |

| 12) Stock Exchange | Click Here |

12th SP Question Paper 2022 with Solution

Q. 1. (A) Select the correct answer from the options given below and rewrite the statement : (5) {20}

1) _____ is related to money and money management.

a) Production

b) Marketing

c) Finance

2) Secured debentures must be redeemed within _____ from the date of its issue.

a) 10 days

b) 10 years

c) 15 years

3) India has a _____ depository system.

a) sole

b) multi

c) single

4) Dividend is to be paid to the shareholders within _____ from the date of declaration.

a) 30 days

b) 40 days

c) 20 days

5) Accumulated dividend is paid to _____ preference shares.

a) redeemable

b) cumulative

c) convertible

(B) Match the pairs : (5)

| Group ‘A’ | Group ‘B’ |

| a) Investment in debenture | 1) Deals with acquisition and use of capital |

| b) Financial market | 2) Must inform stock exchange about dividend declaration |

| c) Price of shares mentioned in prospectus | 3) Trading of financial securities |

| d) Corporate finance | 4) Safe and secure investment |

| e) Listed company | 5) Must inform government about dividend declaration |

| 6) Fixed price issue method | |

| 7) Risky investment | |

| 8) Trading of commodities | |

| 9) Deals with acquisition and use of assets | |

| 10) Book Building method |

Answer

A-4 , B-3 ,C-6 ,D-1 ,E-2

(C) State whether the following statements are true or false: (5)

1) Dividend can be paid out of capital. (False)

2) Deposit can be accepted for a maximum of 6 months. (False)

3) Depository bank stores the shares on behalf of GDR holders. (True)

4) Securities market is an unorganized marketplace in India. (False)

5) Bonus shares are fully paid up shares. (True)

(D) Correct the underlined word/s and rewrite the following sentences: (5)

1) Depositors are owners of the Company. (creditors)

2) Retained earnings are an external source of finance. (internal)

3) To rate its debentures a company appoints underwriters. (credit rating agency)

4) Companies sell fresh shares for the first time to the public in secondary market. (primary market)

5) Preference shareholders get dividend from residual profits. (Equity)

Q. 2. Explain the following terms/concepts : (Any Four) (8)

1) Production Cycle

Answer: The process of converting raw material into finished goods is called production cycle. If the period of production cycle is longer, then the firm needs more amount of working capital. If the manufacturing cycle is short, it requires less working capital.

2) Overdraft

Answer: A company having a current account with a bank is allowed an overdraft facility. The borrower can withdraw funds as and when needed. He is allowed to overdraw on his current account, up to the credit limit which is sanctioned by bank. Within this stipulated limit any number of drawings are permitted. Repayments can be made whenever required during the time period. The interest is determined on the basis of actual amount withdrawn.

3) Employee Stock Purchase Scheme (ESPS)

Answer: Under this scheme, the company offers Equity shares to its employees at a discounted price which they can buy at a future date. The company deducts a certain amount from the salary of the employee towards

the payment for the shares.

Provisions: The company must fulfill the following provisions:

a) Different numbers of shares can be offered to different categories of employees.

b) Shares issued through ESPS should be immediately listed.

c) ESPS shares will have a minimum of one year lock-in period from date of allotment if ESPS is not a part of public issue.

d) Company has to fulfill the provisions of SEBI (Shares Based Employee Benefits) Regulations, 2014.

e) Company has to get the approval of the shareholders through a special Resolution to offer ESPS.

4) Depository Participants (DP)

Answer: It is the agent of the Depositor. DP is registered under the SEBI Act. It enjoys rights and obligations as specified under SEBI (Depositor and Participants) Regulations of 1996. It is an intermediary appointed by Depository. DP acts as a link between Depositor and the investor. It directly deals with customers. It sends statements of accounts periodically. It credits securities in the event of Rights Issue, Bonus Issue, etc. It handles instant transfers of pay-outs like dividend, interest, etc. It settles trade electronically.

5) Rate of Dividend

Answer: a) Dividend rate, expressed as a percentage or yield, is a financial ratio that shows how much a company pays out in dividends each year relative to its stock price.

b) The Board of Directors in the Board Meeting decides the rate of dividend. The rate of final dividend is approved by shareholders in a shareholder’s meeting.

c) The rate of dividend for Equity shareholders fluctuates. and Preference shareholders get dividend at a fixed rate.

6) Right Issue

Answer: When a company wants to raise further capital, it can issue shares to its existing Equity shareholders in proportion to their existing shareholding. Such an issue of shares is called as ‘Rights Issue’ of shares. Whenever a company makes further issue of shares, the existing Equity shareholders have pre-emptive rights to subscribe to the new shares offered by the company.

A company can make a Rights Issue when it is making a private placement.

Q. 3. Study the following case/situation and express your opinion : (Any Two) (6)

(1) Sunflower limited company proposes to issue debenture to the public to raise funds. After discussions, the Board of directors has decided to issue secured, Redeemable non-convertible debentures with a tenure of Ten years. Please advise the board on the following matters :

a) Should the company appoint a Debenture trustee?

Answer: Yes, the company should appoint a debenture trustee as it is mandatory to appoint trustee as and when a company decides to issue secured debentures.

b) Should the company create a charge on its assets?

Answer: All secured debentures are to be secured by creating charge over assets and therefore company should create a charge over assets.

c) Can the tenure of debentures be less than ten years?

Answer: Yes, the tenure of debentures can be less than ten years.

(2) ABC Company Ltd. is an eligible Public Company as per the Companies Act, 2013 with reference to accepting Public Deposits :

a) Can the company accept deposits in joint names?

Answer: Yes, the company can accept deposits in joint names but there should not be more than three names.

b) Can the company accept deposits from its members?

Answer: Yes, the company is eligible as per the Companies Act 2013 and therefore it can accept deposits from its members.

c) Can the company issue secured deposits?

Answer: Yes, the company can issue secured deposits by creating charges over their tangible assets.

1) Joy ltd. Company is a newly incorporated company. It wants to raise capital for the first time by issuing equity shares.

a) Should it go to primary market or secondary market to issue its shares?

Answer: Joy ltd. Should go to primary market to issue its shares as they issuing it for the first time.

b) Should it offer its shares through public offer or rights issue?

Answer: Joy ltd. Should offer it share through public offer to raise capital.

c) What will be the issue of Equity shares by Joy Ltd.Co. called as IPO or FPO

Answer: The issue of Equity shares by Joy Ltd.Co. called as Initial Public Offer (IPO).

Balbharti Textbook Solutions for other subjects

Solution of all Chapters of OCM

1 – 2 – 3 – 4 – 5 – 6 – 7 – 8

Q. 4. Distinguish between the following : (Any Three) (12)

1) Fixed Capital and Working Capital

| Points | Fixed Capital | Working Capital |

| 1) Meaning | Fixed capital refers to any kind of physical asset i.e. fixed assets. | Working capital refers to the sum of current assets. |

| 2) Nature | It stays in the business almost permanently. | Working capital is circulating capital. It keeps changing. |

| 3) Purpose | It is invested in fixed assets such as land, building, equipment, etc. | Working capital is invested in short-term assets such as cash, account receivable, inventory, etc. |

| 4) Sources | Fixed capital funding can come from selling shares, debentures, bonds, long-term loans, etc. | Working capital can be funded with short-term loans, deposits, trade credit, etc. |

| 5) Objectives of Investors | Investors invest money in fixed capital hoping to make future profit. | Investors invest money in working capital for getting immediate returns. |

| 6) Risk | Investment in fixed capital implies more risk. | Investment in working capital is less risky. |

2) Transfer of Shares and Transmission of Shares

| Points | Transfer of Shares | Transmission of Shares |

| 1) Meaning | Transfer of shares means voluntarily or deliberately giving away one’s shares to another person by entering into a contract with the buyer. | It means a transfer of ownership of a member’s shares to his legal representative due to operation of law. It takes place on death, insolvency or insanity of the members. |

| 2) When done | It is done when the member wants to sell his shares or give his shares as gift. | It is done when the member dies or becomes insolvent or insane. |

| 3) Nature of Action | It is a voluntary action taken by the member. | It is an involuntary action. It is due to the operation of law. |

| 4) Parties involved | In transfer of shares, there are two parties involved- the member who is called as transferor and the buyer who is called as transferee. | There is only one party e.g. the nominee of the member in case of death of the member or the legal representative. |

| 5) Instrument of transfer | Transfer requires an Instrument of transfer. It is a contract between the transferor and transferee. | No Instrument of transfer is needed. |

| 6) Initiated by | The transferor initiates the transfer process. | Legal representative or official the receiver initiates the process of transmission. |

| 7) Consideration | Transfer of shares is done often by the member to receive some consideration (money) i.e. the buyer has to pay for the shares. (Except given as gift.) | No consideration is involved here. The legal heir or official receiver need not pay for the shares. |

| 8) Liability | The liability of the transferor ends after the shares are transferred. | Original liability of the member continues in case of transmission of shares. |

| 9) Stamp Duty | Stamp duty as per the market value of shares has to be paid. | No stamp duty is to be paid |

3) Dematerialization and Rematerialization

| Points | Dematerialization | Rematerialization |

| 1) Meaning | Process of converting Physical certificates of securities into electronic form. | It is the process of conversion of the electronic form of securities into physical form. |

| 2) Conversion | Here, the paper form of securities is converted into digital/ electronically held securities. | Here, the electronic records are converted into physical/paper form securities. |

| 3) Use of Form | It uses ‘DRF’ Viz. ‘Dematerialization Request Form’ from Investor to the DP. | It uses ‘RRF’ viz Rematerialization Request Form’ from Investor to the DP. |

| 4) Sequence | This is an initial process. It is a primary and Principal function of the depository. | This is a reverse process. It is a secondary and supporting function of depository. Already demated securities are remated. |

| 5) Identification of Securities | Demated securities have no distinctive numbers. They are fungible. | Remated securities will have certificate and distinctive numbers as issued by company. |

| 6) Securities Maintenance Authority | Depository is the custodian of securities and records. | The issuing company is the record keeping authority. Securities are maintained b the investor. |

| 7) Difficult of Process | Demat is an easy process. Also it’s not a time-consuming process. | Remat is not only time-consuming but also a complex process. |

4) Primary market and Secondary market

| Points | Primary Market | Secondary Market |

| 1) Meaning | The issue of new shares by the company is done in the primary market. | The securities issued earlier are traded in the secondary market. |

| 2) Mode of Investment | Direct investment in the securities. Securities are acquired directly from the company. | Indirect investment as the securities are acquired from other stakeholders. |

| 3) Parties in action | The parties dealing in this market are company and investors. | The parties dealing in this market are only investors. |

| 4) Intermediary | The underwriters are the intermediaries. | The security brokers are the intermediaries. |

| 5) Value of security | The price of security in the primary market is fixed as it is decided by the company. | The price of security is fluctuating, depending on the demand and supply conditions in the market. |

Q. 5. Answer the following questions in brief: (Any Two) (8)

1. State the features of Bonds?

Answer: A bond is a debt security. It is a formal contract to repay borrowed money with interest. A bond is a loan. The holder of the bond is a lender to the institution. He is a creditor of the company. He gets a fixed rate of interest.

All bonds have a maturity date and are paid in cash at a certain date in the future.

According to Webster Dictionary, ‘A bond is an interest bearing certificate issued by the government or business firm, promising to pay the holder a specific sum at a specified date.’ Thus a company borrows money and issues bonds as evidence of debt. Interest is payable on bonds at fixed interval or on maturity of bonds.

Features:

a) Nature of Finance:

It is debt Finance. It provides long-term finance. The bonds can be issued for longer periods i.e. 5 years, 10 years, 25 years, or 50 years.

b) Status of bondholder:

The bondholders are creditors. Since they are creditors and non-owners they are not entitled to participate in general meetings. They have no voting rights and hence no participation in the management.

c) Return on bonds:

The bondholder gets a fixed rate of interest. It is payable at regular intervals or on the maturity of a bond.

d) Repayment:

Bonds have a specific maturity date on when the principal amount is repaid.

2) Explain any four advantages of Depository System to investors.

Answer: Under Depositor System, securities are held in electronic form. The transfer and settlement of securities are done electronically. The Depositor System maintains accounts of the shareholder, enables transfer, collects dividends, bonus shares, etc. on behalf of the shareholder. This system is also called a scripless trading system.

Advantages of Depository System to Investors:

1) Elimination of Risk:

All risks associated with physical certificates like delays, loss, theft, mutilation, bad deliveries, etc. are totally eliminated.

2) Safety:

It is the safest and most secure way of holding securities. The entire system functions under the Depositor Act and is monitored b SEBI. e.g. The Investor can keep his account in a ‘Freeze / Lock’ mode to avoid/prevent unexpected debit or credit or both by giving instructions to the DP.

3) Easy Transfer of shares:

(a) Efforts in filling transfer forms and lodging the documents are eliminated.

(b) Also the stamp duty levied on transfer of physical shares is not applicable.

(c) Processing time in transfer of securities is reduced and neither the securities nor the cash is tied/held up for an unnecessarily long time.

4) Updates and Intimation:

The investor is provided with the status of the holdings and transactions by DP and occasionally by the Depository too.

5) Security against Loan:

Dematerialized securities are preferred b banks and financial institutions as security against loans.

3. Explain the features of interest.

Answer: In financial terms, it is a payment made for using money of another. i.e. Borrower takes money from the lender.

So interest is the cost of renting money, for the borrower and it is the income from lending money for the lender. It is the return payable to the creditors of the company viz. Debenture holder / Deposit holders for the loan given by them to the company.

Following are the features of Interest:

1) Interest is the price paid for the productive services rendered by capital.

2) It is directly related to risk. Higher the risk, higher is the interest.

3) Rate of Interest is expressed as annual percentage of Principal.

4) Rate of interest is determined by various factors like money supply, fiscal policy, the volume of borrowings, rate of inflation etc.

5) Interest is a charge against the profit of the company. Even if company makes no profit, interest should be paid.

6) It is payable at a fixed and generally pre-determined rate.

Q. 6. Justify the following statement : (Any Two) (8)

1) The Board of Directors can refuse transfer of shares.

Answer:

a) Transfer of shares means voluntary transfer of shares by a member of a company in favour of another person.

b) Board of Directors has the authority to refuse the registration of the transfer of shares.

c) The Board may refuse to register the transfer under the following conditions :

i) When the provisions for transfer of shares as given in the Articles of Association have not fulfilled by the member.

ii) When the instrument of transfer is not as per the rules prescribed under the Companies Act.

iii) When the Instrument is not accompanied by the Share Certificate.

iv) When the company has a lien on the shares to be transferred.

d) Therefore board of directors can refuse transfer of shares.

2) The Securities and Exchange Board of India (SEBI) is the regulator for the securities market in India.

Answer:

a) The Securities and Exchange Board of India (SEBI) is the regulator of the capital markets in India. The SEBI was established in 1992 under the Securities and Exchange Board of India Act, 1992.

b) SEBI was set up to promote the securities market, protecting the interest of the investors in the securities market, and regulating the securities market.

c) SEBI issues rules and regulations to be followed by the issuers of securities, the market intermediaries, and the investors. It is a regulator of all the Stock exchanges in India.

d) SEBI also regulates the working of venture capital funds and collective investment schemes including mutual funds.

Thus, the Securities and Exchange Board of India (SEBI) is the regulator for the securities market in India.

3) Unpaid dividend cannot be used by the company.

Answer:

a) The dividend declared by the company but has not been paid to or claimed by a shareholder within 30 days of its declaration is termed as an unpaid dividend.

b) The total amount of dividend which remains unpaid should be transferred to ‘Unpaid Dividend Account’.

c) Any amount in the Unpaid Dividend Account of a Company that remains unpaid/unclaimed for a period of 7 years will be transferred to ‘Investors Education and Protection Fund’.

d) The company cannot use unpaid dividends.

e) The only claimant of money can claim for it by following certain procedures.

Thus, it is rightly said that unpaid dividends cannot be used by the company.

4) A company can issue duplicate share certificate.

Answer:

a) A company can issue a duplicate share certificate if :

i) Original share certificate has been defaced, mutilated, or torn and is surrendered to the company.

ii) It has been proved by the holder that the original share certificate is lost or destroyed.

b) In case of loss of share certificate, the company puts up a notice in the newspapers to announce the loss of the Share Certificate.

c) If the company does not get any response from the public, within the specified time, then the company can issue a duplicate Share Certificate.

d) Duplicate share certificate should be issued within three months from the date of application. The company issues it only to registered shareholders.

Thus it is rightly justified that, A company can issue duplicate share certificates.

Q. 7. Attempt the following : (Any Two) (10)

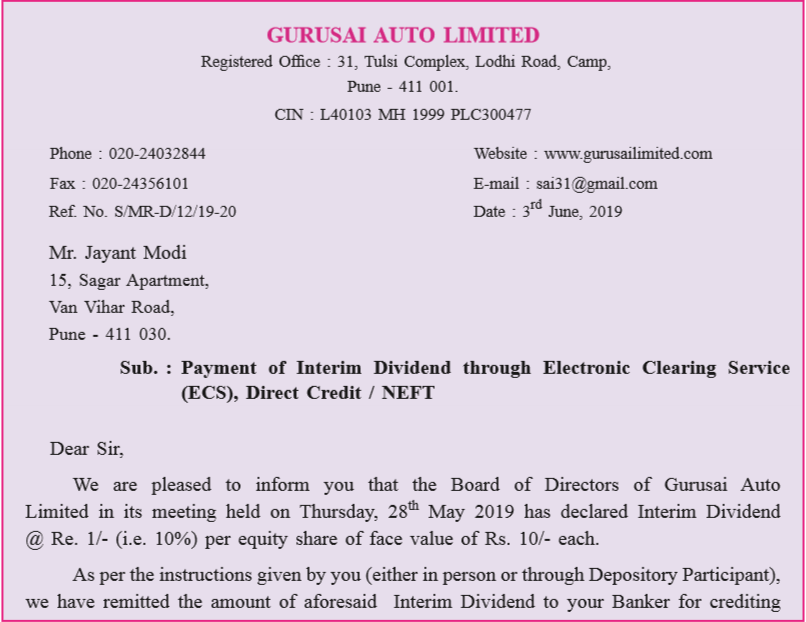

1) Write a letter to the member for the payment of the Interim dividend electronically.

Answer:

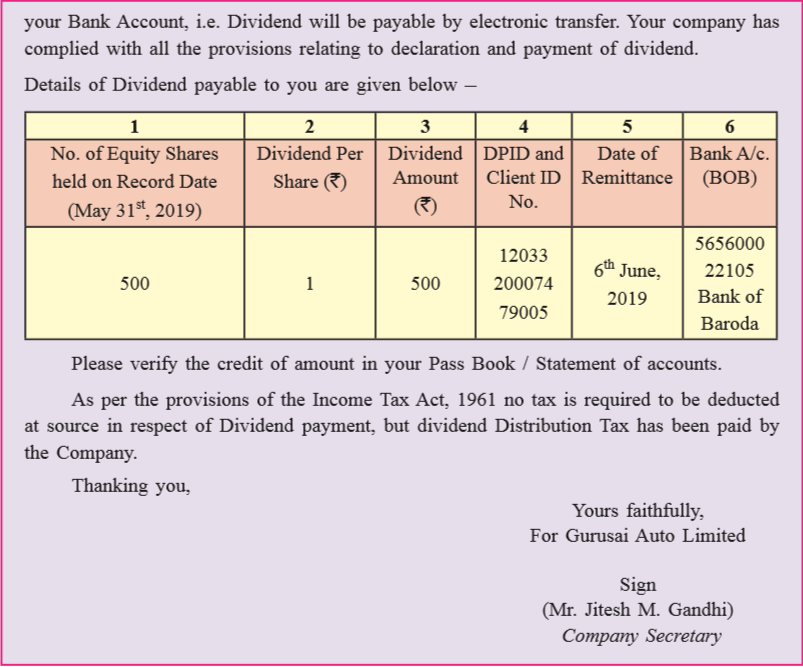

2) Write a letter to the debenture holder regarding payment of interest through Interest Warrant.

Answer:

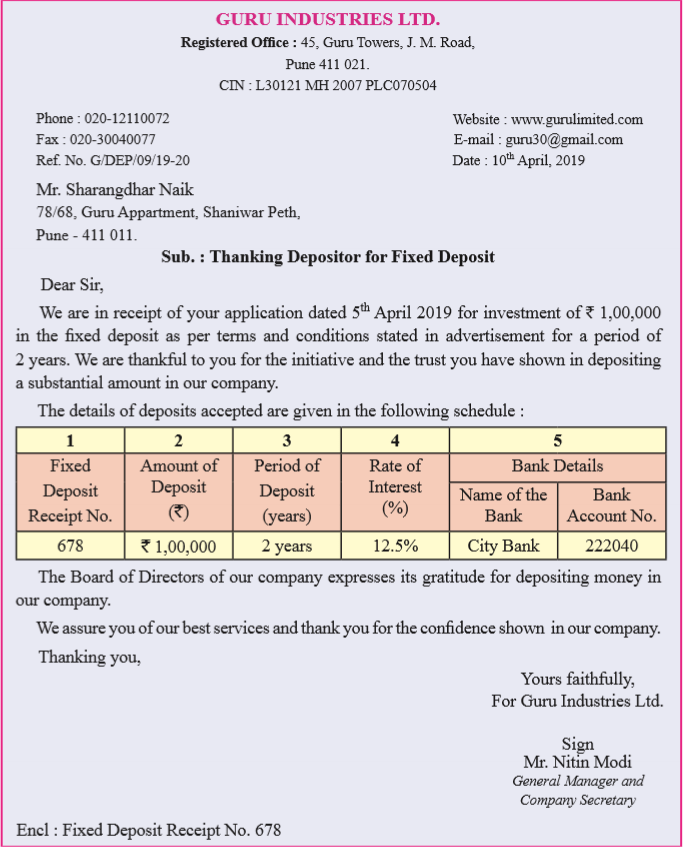

3) Draft a letter of thanks to the depositor of a company.

Answer:

Q. 8. Answer the following questions : (Any One) (8)

1. What are Preference shares? Explain its types.

Answer:

Preference Shares:

As the name indicates, these shares have certain preferential rights distinct from those attached to equity shares.

The shares which carry the following preferential rights are termed as preference shares :

a) A preferential right as to payment of dividend during the lifetime of the company.

b) A preferential right as to the return of capital in the event of winding up of the company.

The holder of the preference share has a prior right to receive a fixed rate of dividend before any dividend is paid to equity shares. The rate of dividend is prescribed at the time of issue.

Types of Preference Shares.

1) Cumulative Preference Shares:

Cumulative Preference Shares are those shares on which dividend goes on accumulating until it is fully paid. This means, if the dividend is not paid in one or more years due to inadequate profits, then this unpaid dividend gets accumulated. This accumulated dividend is paid when company performs well.

2) Non-cumulative Preference Shares:

Dividend on these shares does not get accumulated. This means, the dividend on shares can be paid only out of profits of that year. The right to claim dividend will lapse, if company does not make profit in that particular year. If dividend is not paid in any year, it is lost forever.

3) Participating Preference Shares:

The holders of these shares are entitled to participate in surplus profit besides preferential dividend. The surplus profit which remains after the dividend has been paid to equity shareholders, up to certain limit, is distributed to preference shareholders.

4) Non-participating Preference Shares:

The preference shares are deemed to be non-participating if there is no clear provision in the Articles of Association. These shareholders are entitled to fixed rate of divided, prescribed at the time of issue.

5) Convertible Preference Shares:

The holders of these shares have a right to convert their preference shares into equity shares. The conversion takes place within a certain fixed period.

6) Non-convertible Preference Shares:

These shares cannot be converted into equity shares.

7) Redeemable Preference Shares:

Shares that can be redeemed after certain fixed period of time are called redeemable preference shares. A company limited by shares if authorized by Articles of Association, issues redeemable preference shares. Such shares must be fully paid. These shares are redeemed out of divisible profit only or out of fresh issue of shares made for this purpose.

8) Irredeemable Preference Shares:

Shares that are not redeemable i.e. payable only on winding up of the company are called irredeemable preference shares. As per Section 55(1) of the Companies Act 2013, a company cannot issue irredeemable preference shares.

2. Explain the provisions of Companies Act 2013 for issue of debentures.

Answer: Debentures are one of the principal sources of raising borrowed capital to meet long and medium-term financial needs.

The term debenture has come from the Latin word ‘debere’ which means to ‘owe’.

The term debenture has not been defined clearly under the Companies Act.

Sec 2(30) of the Companies Act 2013, only states that ‘the word debenture includes debenture stock, bonds and any other instrument of a company evidencing a debt, whether constituting a charge on the assets of the company or not.

Following are some of the provisions of the Act which a company has to comply while issuing debentures:

1) No voting rights:

A company cannot issue debentures with voting rights. Debenture holders are creditors of the company and so they do not have any voting rights except in matters affecting them.

2) Types of Debentures:

A company can issue secured or unsecured debentures and fully or partly convertible debentures or non-convertible debentures. To issue convertible debentures, a Special Resolution has to be passed in the General Meeting. All debentures are redeemable in nature.

3) Payment of interest and redemption:

A company shall redeem the debentures and pay interest as per the terms and conditions of their issue.

4) Debenture Certificate:

Company has to issue a Debenture certificate to the debenture holders within 6 months of allotment of Debentures.

5) Create Debenture Redemption Reserve:

Company has to create a Debenture Redemption Reserve account out of profits of the company available for payment of dividend. This money can be used only for redemption of debentures. As per companies (Share Capital and Debentures) Amendment Rules 2019, MCA has removed Debenture Redemption Reserve requirement for Listed companies, NBFCs, and Housing Finance Companies.

6) Appoint of Debenture Trustees:

If the company issues prospectus or invites more than 500 people, (either to Public or its Member) company has to appoint one or more Debenture Trustees. Debenture trustees protect the interest of the debenture holders. Company has to appoint trustees by entering into a contract with them called a Debenture Trust Deed.

7) Debenture Trustees can approach NCLT:

Debenture Trustees have to redress the grievances of debenture holders. If the company defaults in repaying the principal amount, on maturity or defaults in paying interest thereon, the Debenture Trustees can approach the National Company Law Tribunal for redressal. NCLT can direct a defaulting company to repay the principal amount or interest.

8) Impose restrictions:

When the Debenture Trustee is of the opinion that the assets of the company are insufficient or likely to become insufficient to redeem the principal amount of debentures, it may approach the NCLT.

9) Punishment for contravention of provisions of the Companies Act:

If the company fails to comply with any provisions of the Act, then the company and its officers shall be liable to pay a fine or imprisonment or both as prescribed in the Act.

Balbharti Textbook Solutions for other subjects

Solution of all Chapters of OCM

1 – 2 – 3 – 4 – 5 – 6 – 7 – 8

- 12th OCM 2021 Board Papers

- 12th SP 2021 Board Papers

- 12th English 2021 Board Papers

- 12th Accounts 2021 Board Papers

Check out other posts related to the 12th Commerce

| Textbook Solutions of 12th Commerce (All Subjects) | Click Here |

| Free pdf of 12th Commerce Textbooks | Click Here |

| 12th Commerce IT MCQ Preparation (Online Test) | Click Here |

| 12th Commerce Paper Pattern and Chapter Wise Marks Distribution | Click Here |

| Sample Paper of 12th Commerce for Practice | Click Here |

| Solved Sample papers of 12th Commerce to improve Paper Presentation | Click Here |

| Old Question Papers of 12th Commerce with solution (All Subjects) | Click Here |

12th OCM Sample Question Paper

How to write OCM paper in board Exam – Watch Video

![12th BK Paper Pattern 2023-24 | Maharashtra Board [Download Free PDF] 11 BK Paper Pattern 2023](https://scholarsclasses.com/blog/wp-content/uploads/2023/10/Screenshot-2023-10-23-at-3.20.20-PM-520x245.png)

This is really really useful to me 😊 thanks 🙏

You are most welcome.

Keep learning and Keep Sharing.

Very helpful

Keep Learning and keep growing.